Connecting Innovation to Purpose NASDAQ: CRBP Corporate Presentation November 7, 2024 Exhibit 99.2

This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and Private Securities Litigation Reform Act, as amended, including those relating to the Company’s trial results, product development, clinical and regulatory timelines, market opportunity, competitive position, possible or assumed future results of operations, business strategies, potential growth opportunities, including timing or completion of trials and presentation of data and other statements that are predictive in nature. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which we operate and management’s current beliefs and assumptions. These statements may be identified by the use of forward-looking expressions, including, but not limited to, “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “potential,” “predict,” “project,” “should,” “would” and similar expressions and the negatives of those terms. These statements relate to future events or our financial performance and involve known and unknown risks, uncertainties, and other factors, on our operations, clinical development plans and timelines, which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include those set forth in the Company’s filings with the Securities and Exchange Commission. Prospective investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this presentation. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. All product names, logos, brands and company names are trademarks or registered trademarks of their respective owners. Their use does not imply affiliation or endorsement by these companies. Forward-Looking Statements

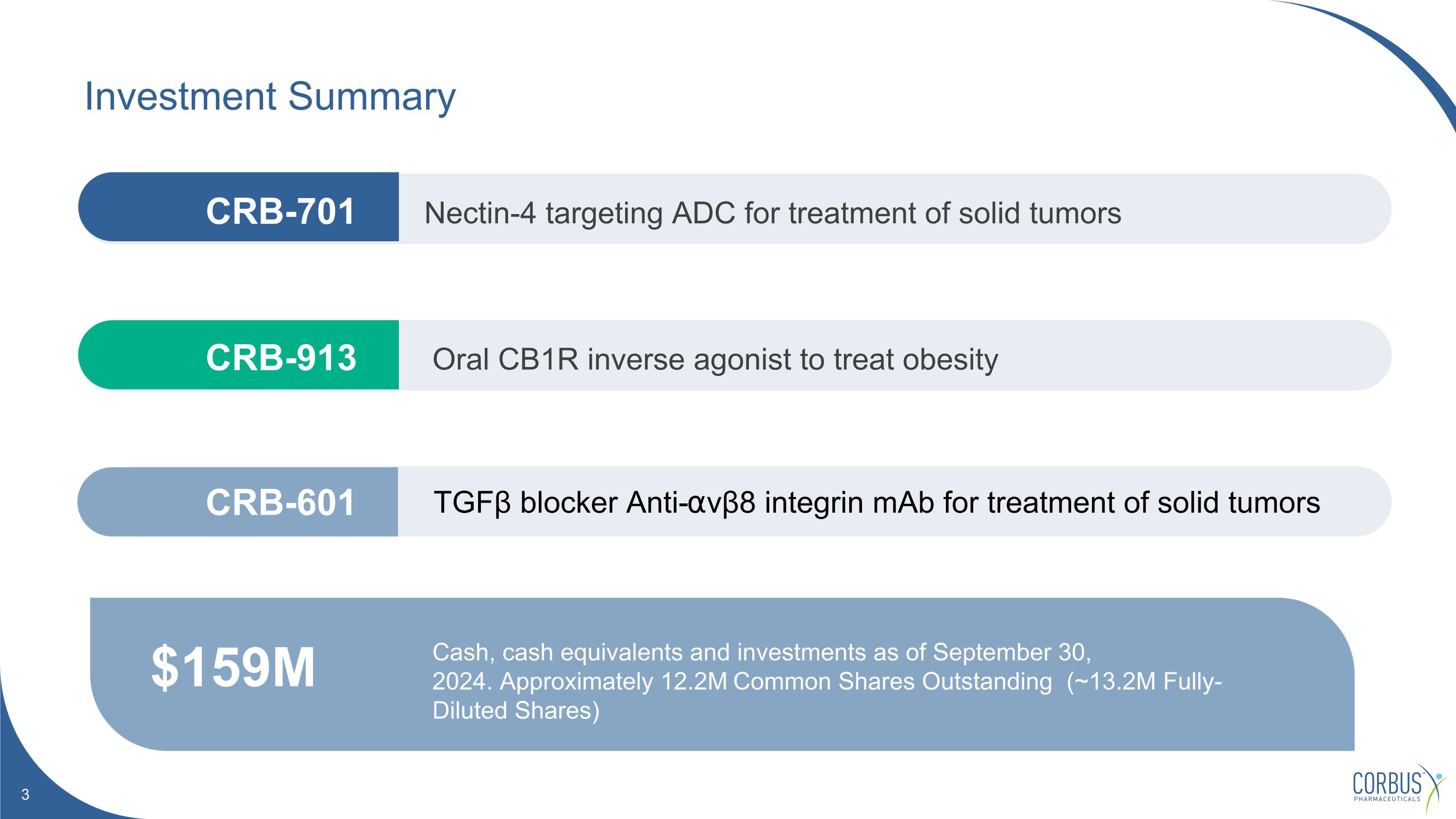

Investment Summary $159M Cash, cash equivalents and investments as of September 30, 2024. Approximately 12.2M Common Shares Outstanding (~13.2M Fully-Diluted Shares) Nectin-4 targeting ADC for treatment of solid tumors Oral CB1R inverse agonist to treat obesity TGFβ blocker Anti-⍺vβ8 integrin mAb for treatment of solid tumors CRB-913 CRB-601 CRB-701

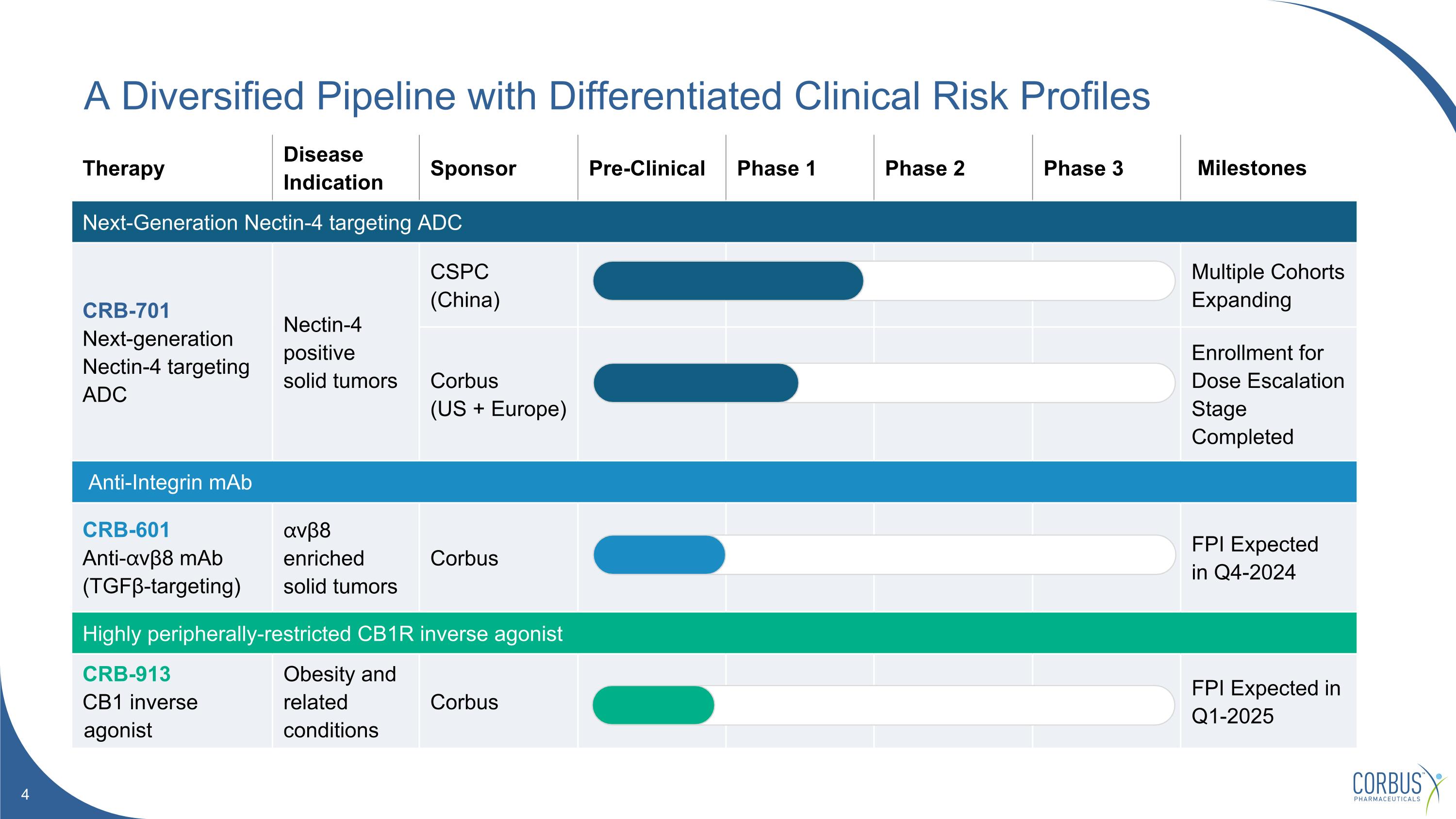

Therapy Disease Indication Sponsor Pre-Clinical Phase 1 Phase 2 Phase 3 Milestones Next-Generation Nectin-4 targeting ADC CRB-701 Next-generation Nectin-4 targeting ADC Nectin-4 positive solid tumors CSPC (China) Multiple Cohorts Expanding Corbus (US + Europe) Enrollment for Dose Escalation Stage Completed Anti-Integrin mAb CRB-601 Anti-⍺vβ8 mAb (TGFβ-targeting) ⍺vβ8 enriched solid tumors Corbus FPI Expected in Q4-2024 Highly peripherally-restricted CB1R inverse agonist CRB-913 CB1 inverse agonist Obesity and related conditions Corbus FPI Expected in Q1-2025 A Diversified Pipeline with Differentiated Clinical Risk Profiles

CRB-701 Next-Generation Nectin-4 Targeting ADC

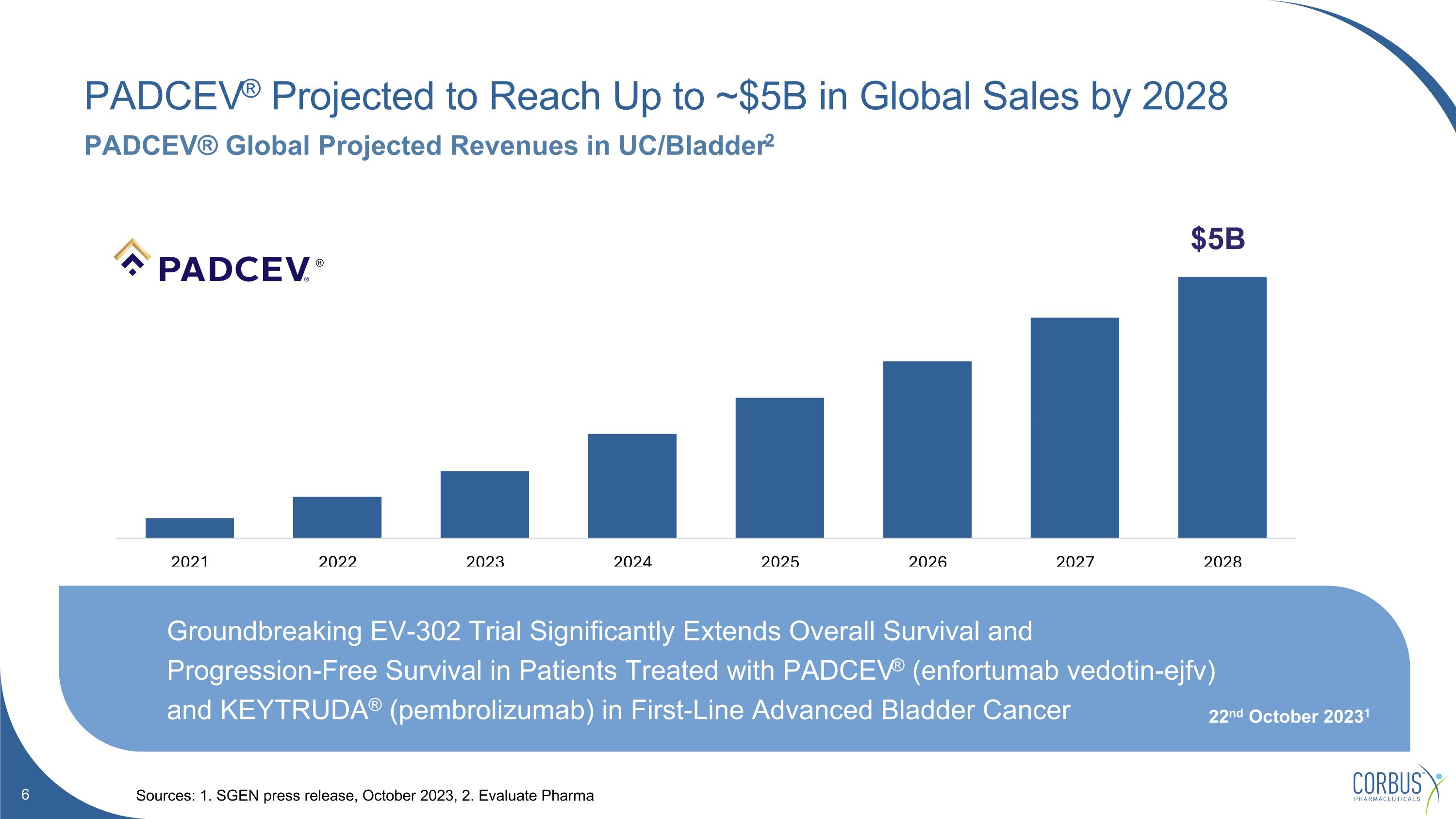

PADCEV® Projected to Reach Up to ~$5B in Global Sales by 2028 Sources: 1. SGEN press release, October 2023, 2. Evaluate Pharma PADCEV® Global Projected Revenues in UC/Bladder2 $5B Latest Padcev® Q3 revenues 1 22nd October 2023 2 ® Groundbreaking EV-302 Trial Significantly Extends Overall Survival and Progression-Free Survival in Patients Treated with PADCEV® (enfortumab vedotin-ejfv) and KEYTRUDA® (pembrolizumab) in First-Line Advanced Bladder Cancer 22nd October 20231

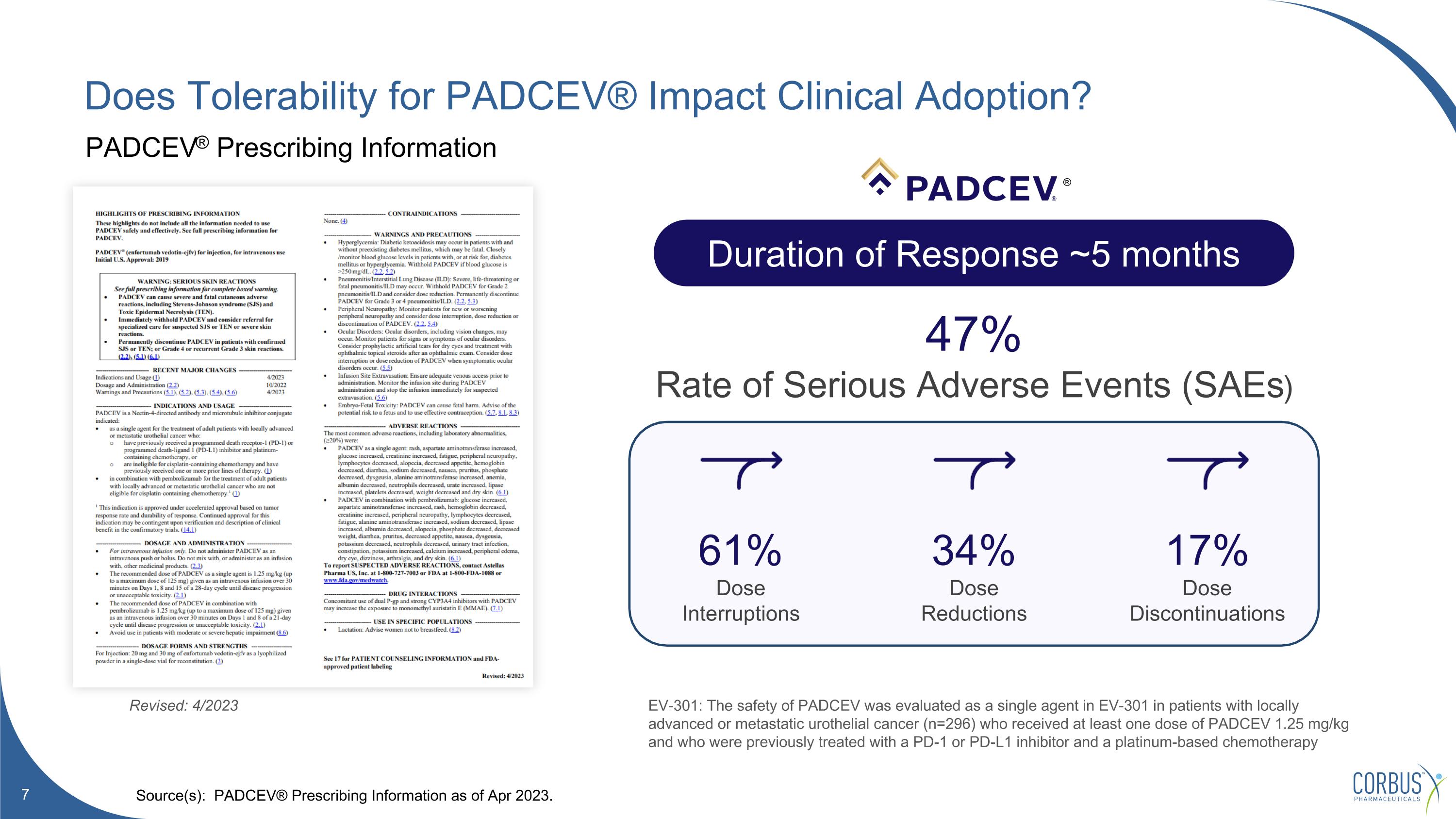

Does Tolerability for PADCEV® Impact Clinical Adoption? Source(s): PADCEV® Prescribing Information as of Apr 2023. Duration of Response ~5 months 47% Rate of Serious Adverse Events (SAEs) 61% Dose Interruptions 34% Dose Reductions 17% Dose Discontinuations Revised: 4/2023 PADCEV® Prescribing Information EV-301: The safety of PADCEV was evaluated as a single agent in EV-301 in patients with locally advanced or metastatic urothelial cancer (n=296) who received at least one dose of PADCEV 1.25 mg/kg and who were previously treated with a PD-1 or PD-L1 inhibitor and a platinum-based chemotherapy ®

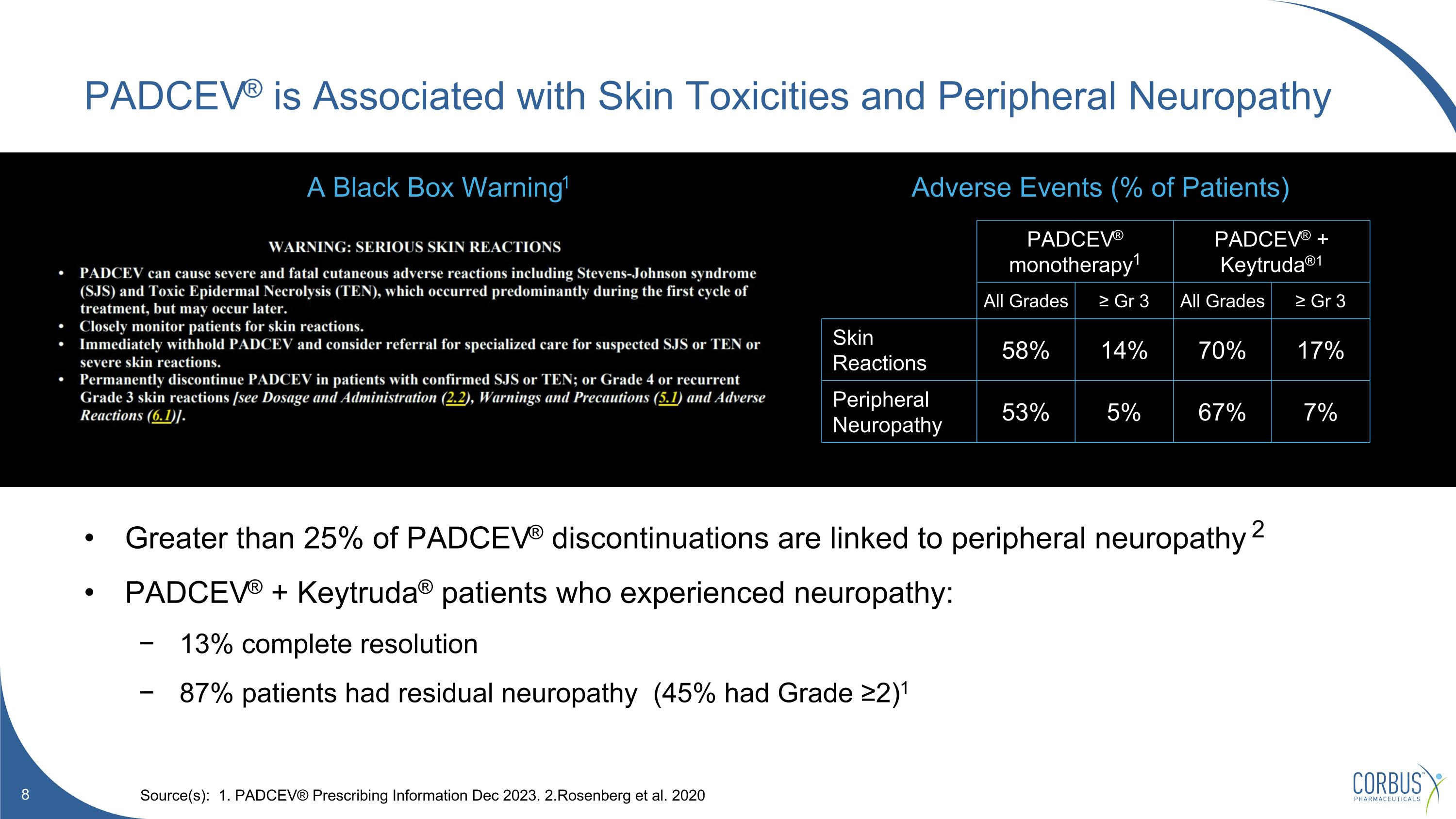

PADCEV® is Associated with Skin Toxicities and Peripheral Neuropathy Source(s): 1. PADCEV® Prescribing Information Dec 2023. 2.Rosenberg et al. 2020 Adverse Events (% of Patients) ® A Black Box Warning1 Greater than 25% of PADCEV® discontinuations are linked to peripheral neuropathy 2 PADCEV® + Keytruda® patients who experienced neuropathy: 13% complete resolution 87% patients had residual neuropathy (45% had Grade ≥2)1 PADCEV® monotherapy1 PADCEV® + Keytruda®1 All Grades ≥ Gr 3 All Grades ≥ Gr 3 Skin Reactions 58% 14% 70% 17% Peripheral Neuropathy 53% 5% 67% 7%

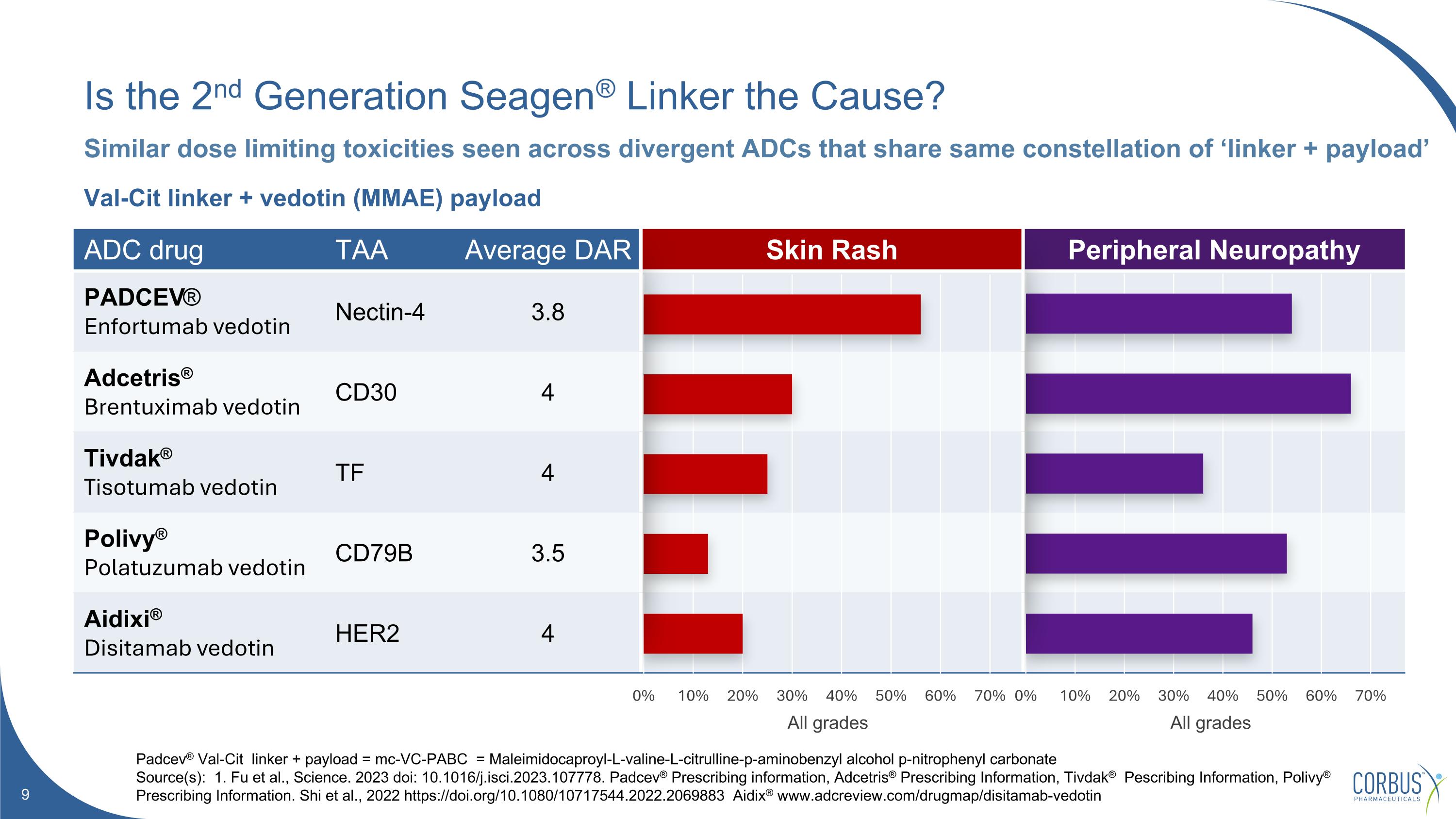

ADC drug TAA Average DAR Skin Rash Peripheral Neuropathy PADCEV® Enfortumab vedotin Nectin-4 3.8 Adcetris® Brentuximab vedotin CD30 4 Tivdak® Tisotumab vedotin TF 4 Polivy® Polatuzumab vedotin CD79B 3.5 Aidixi® Disitamab vedotin HER2 4 Is the 2nd Generation Seagen® Linker the Cause? Padcev® Val-Cit linker + payload = mc-VC-PABC = Maleimidocaproyl-L-valine-L-citrulline-p-aminobenzyl alcohol p-nitrophenyl carbonate Source(s): 1. Fu et al., Science. 2023 doi: 10.1016/j.isci.2023.107778. Padcev® Prescribing information, Adcetris® Prescribing Information, Tivdak® Pescribing Information, Polivy® Prescribing Information. Shi et al., 2022 https://doi.org/10.1080/10717544.2022.2069883 Aidix® www.adcreview.com/drugmap/disitamab-vedotin Similar dose limiting toxicities seen across divergent ADCs that share same constellation of ‘linker + payload’ Val-Cit linker + vedotin (MMAE) payload All grades All grades

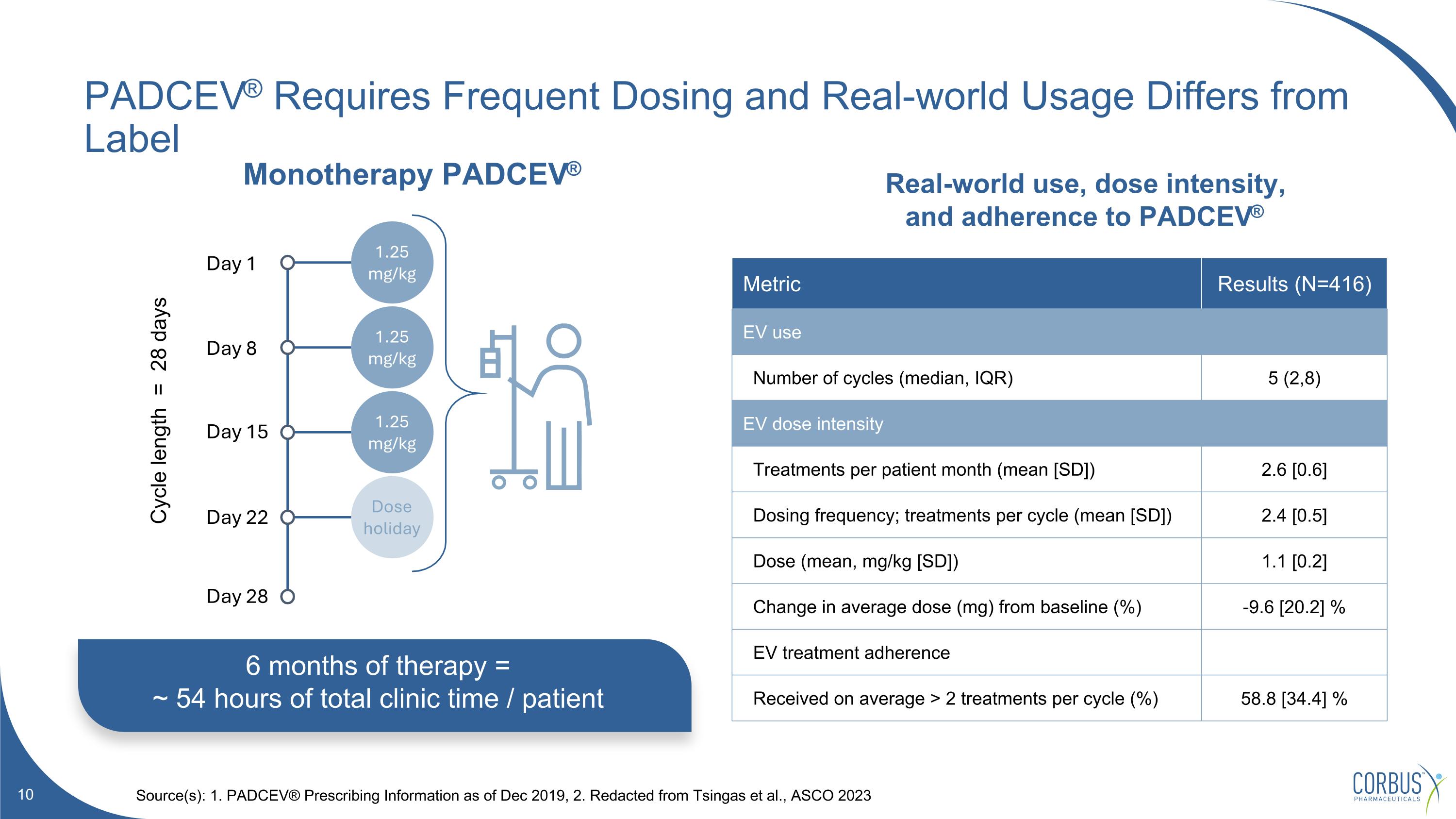

6 months of therapy = ~ 54 hours of total clinic time / patient Real-world use, dose intensity, and adherence to PADCEV® PADCEV® Requires Frequent Dosing and Real-world Usage Differs from Label Source(s): 1. PADCEV® Prescribing Information as of Dec 2019, 2. Redacted from Tsingas et al., ASCO 2023 Monotherapy PADCEV® Metric Results (N=416) EV use Number of cycles (median, IQR) 5 (2,8) EV dose intensity Treatments per patient month (mean [SD]) 2.6 [0.6] Dosing frequency; treatments per cycle (mean [SD]) 2.4 [0.5] Dose (mean, mg/kg [SD]) 1.1 [0.2] Change in average dose (mg) from baseline (%) -9.6 [20.2] % EV treatment adherence Received on average > 2 treatments per cycle (%) 58.8 [34.4] % Cycle length = 28 days 1.25 mg/kg 1.25 mg/kg 1.25 mg/kg Dose holiday Day 1 Day 8 Day 15 Day 22 Day 28

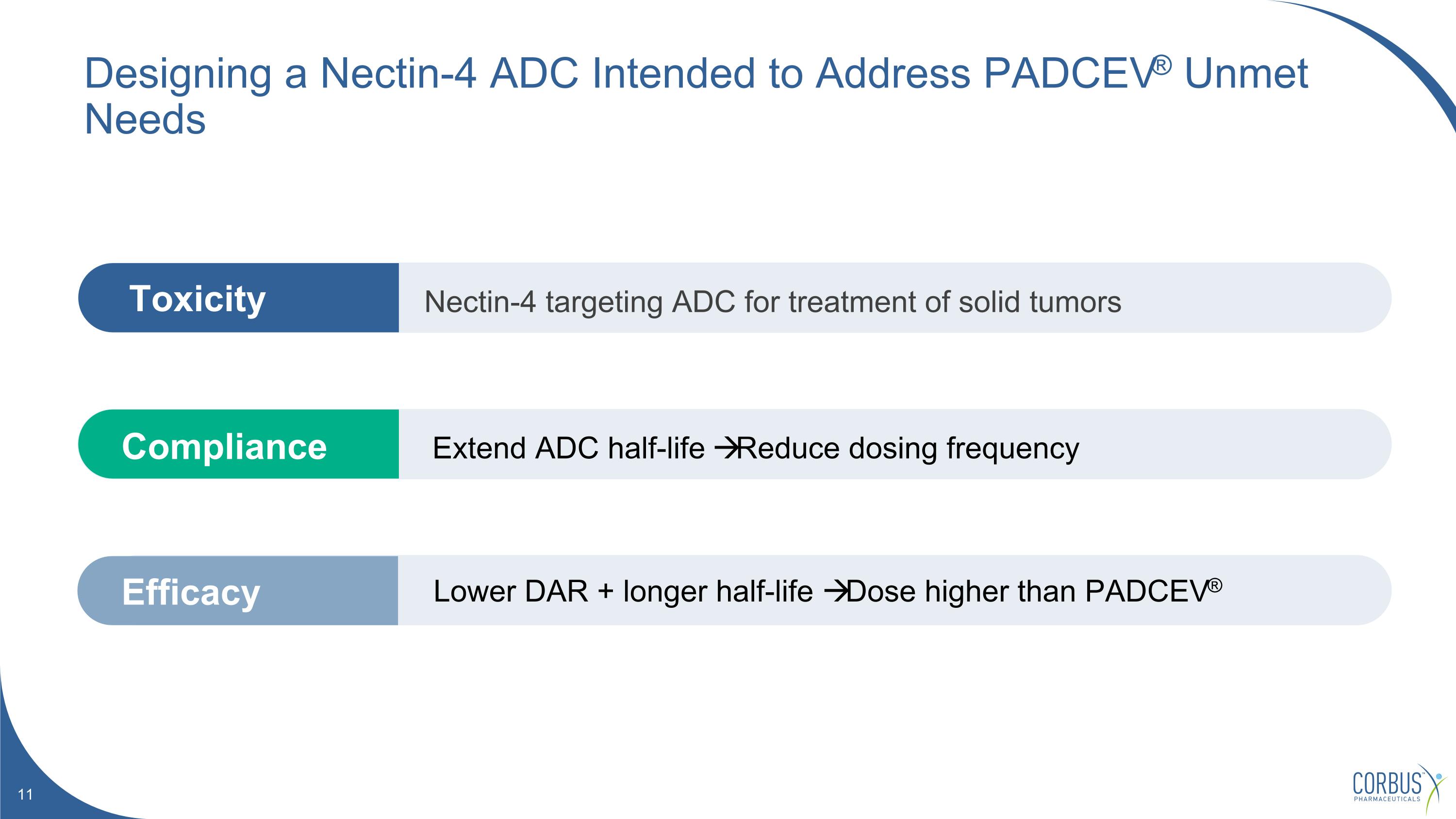

Nectin-4 targeting ADC for treatment of solid tumors Extend ADC half-life Reduce dosing frequency Lower DAR + longer half-life Dose higher than PADCEV® Compliance Efficacy Toxicity Designing a Nectin-4 ADC Intended to Address PADCEV® Unmet Needs

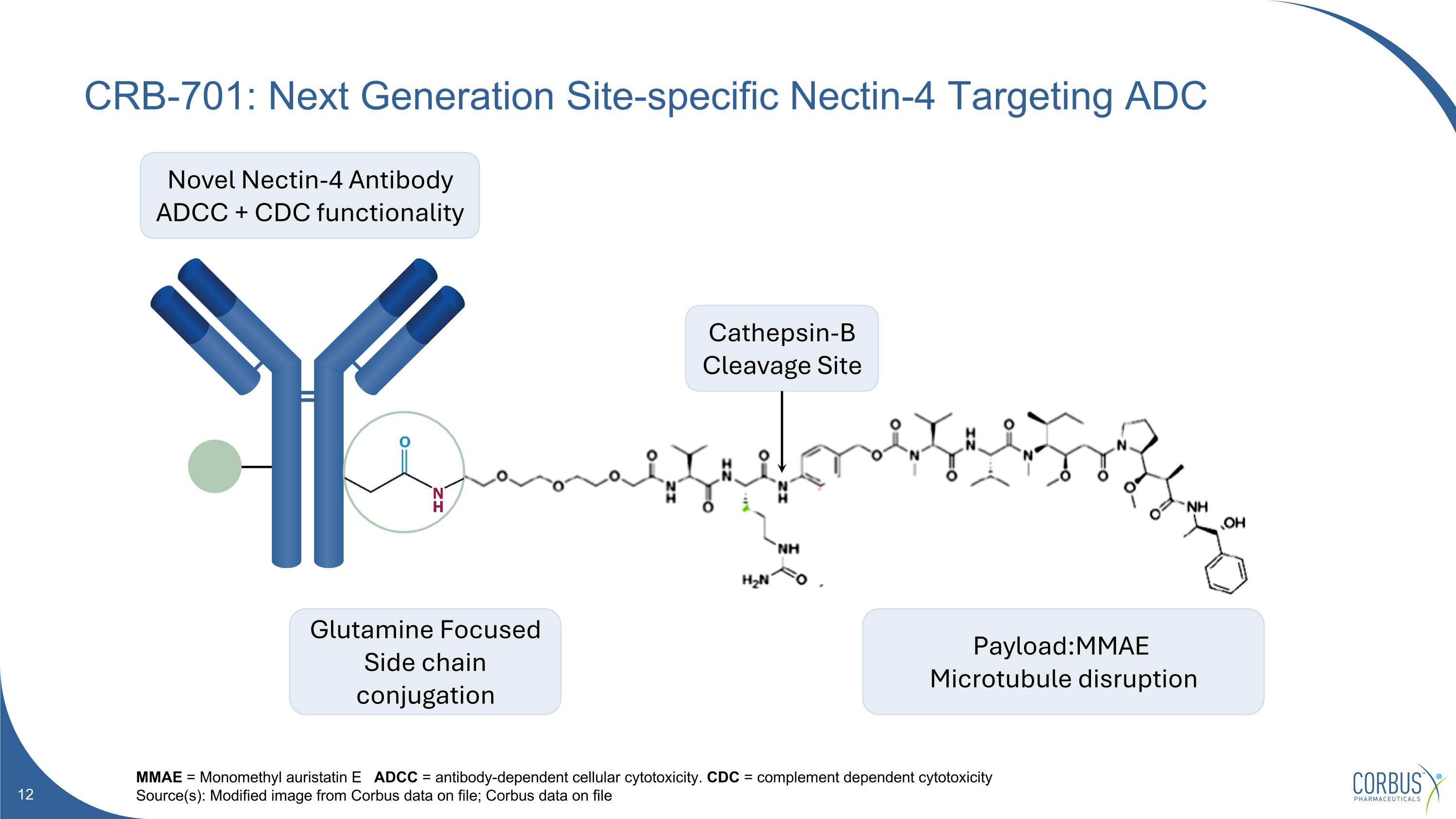

CRB-701: Next Generation Site-specific Nectin-4 Targeting ADC MMAE = Monomethyl auristatin E ADCC = antibody-dependent cellular cytotoxicity. CDC = complement dependent cytotoxicity Source(s): Modified image from Corbus data on file; Corbus data on file Novel Nectin-4 Antibody ADCC + CDC functionality Glutamine Focused Side chain conjugation Payload:MMAE Microtubule disruption Cathepsin-B Cleavage Site

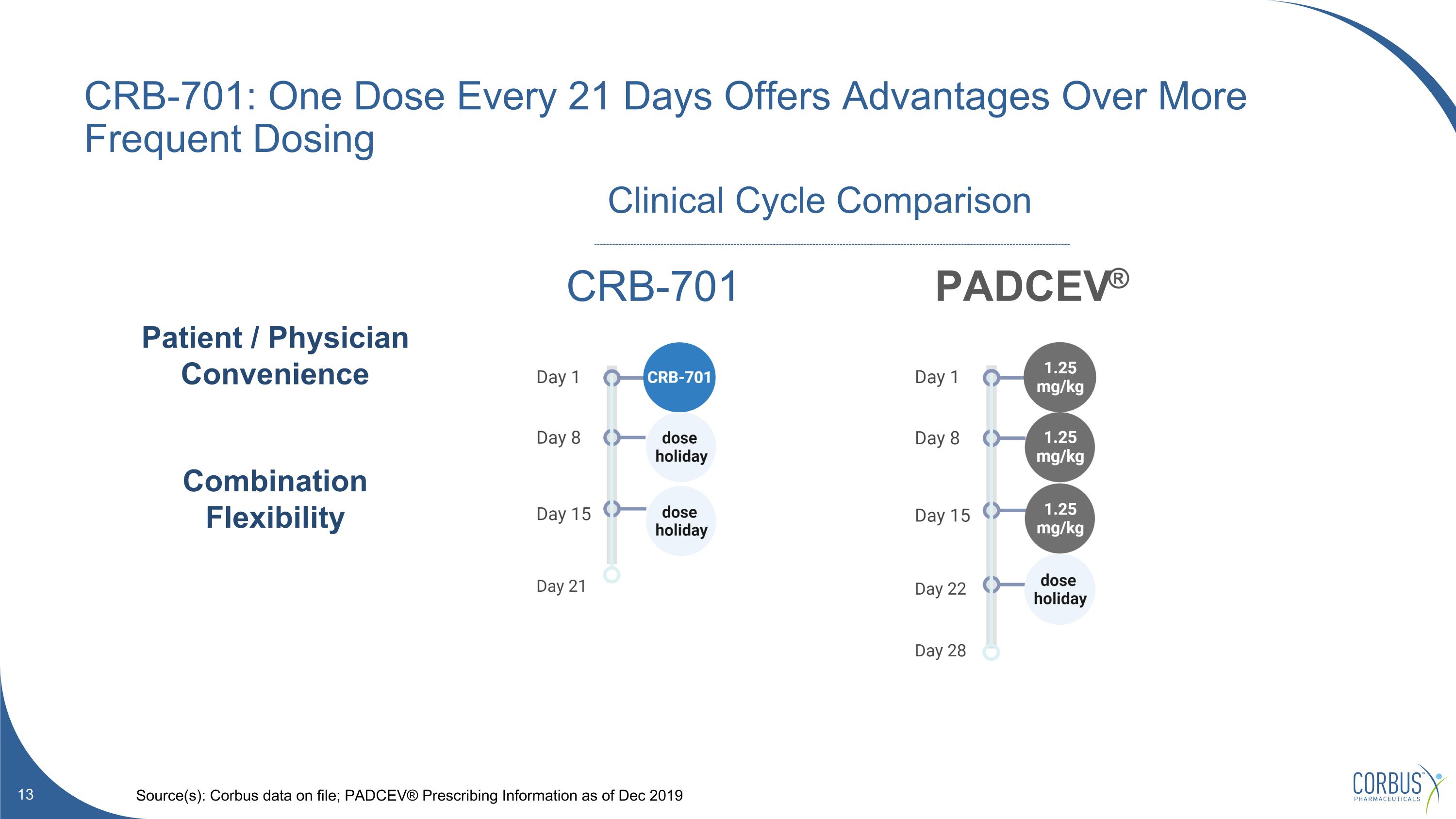

CRB-701: One Dose Every 21 Days Offers Advantages Over More Frequent Dosing Source(s): Corbus data on file; PADCEV® Prescribing Information as of Dec 2019 PADCEV® CRB-701 Clinical Cycle Comparison Patient / Physician Convenience Combination Flexibility

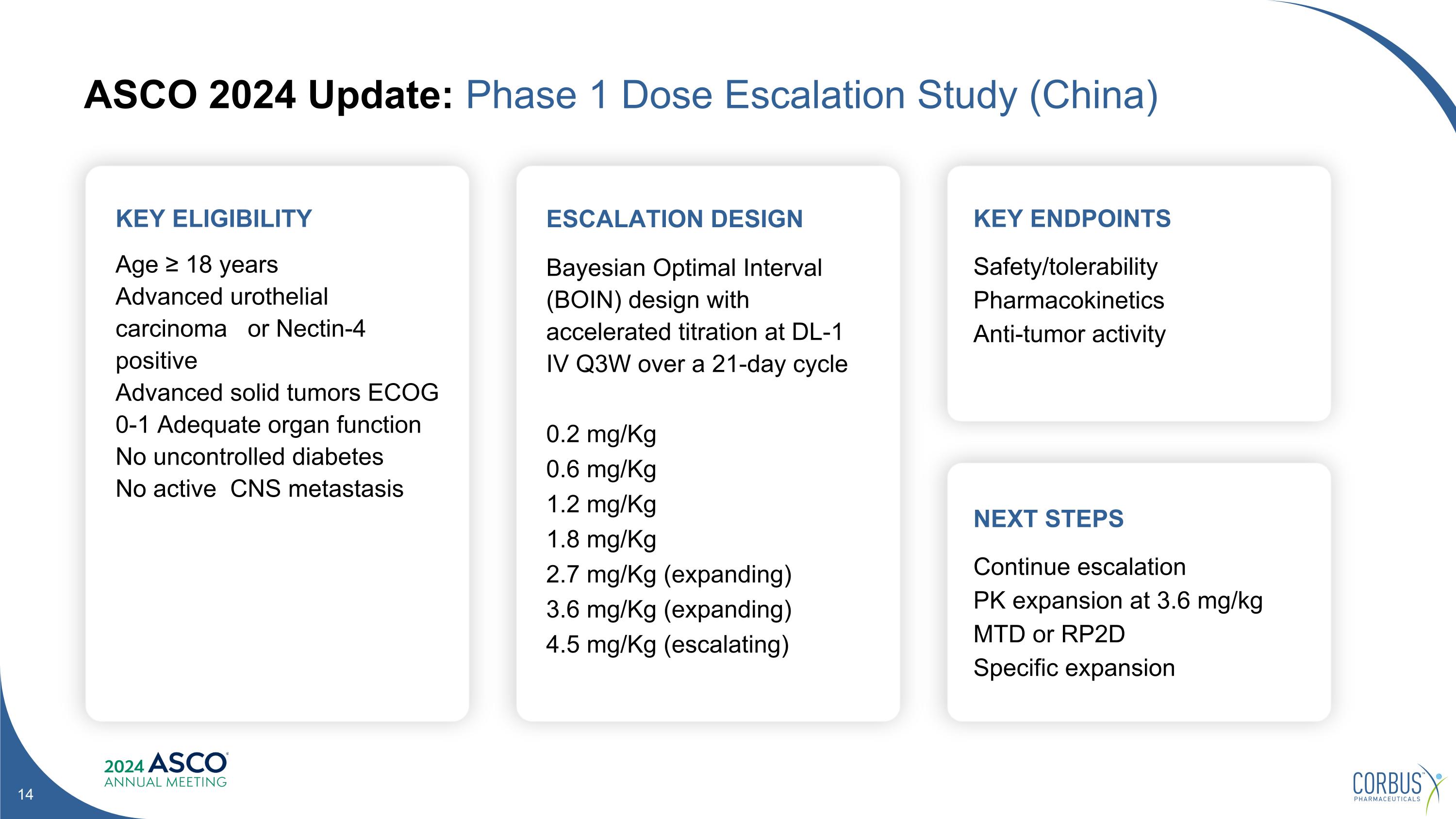

ASCO 2024 Update: Phase 1 Dose Escalation Study (China) KEY ELIGIBILITY Age ≥ 18 years Advanced urothelial carcinoma or Nectin-4 positive Advanced solid tumors ECOG 0-1 Adequate organ function No uncontrolled diabetes No active CNS metastasis ESCALATION DESIGN Bayesian Optimal Interval (BOIN) design with accelerated titration at DL-1 IV Q3W over a 21-day cycle 0.2 mg/Kg 0.6 mg/Kg 1.2 mg/Kg 1.8 mg/Kg 2.7 mg/Kg (expanding) 3.6 mg/Kg (expanding) 4.5 mg/Kg (escalating) KEY ENDPOINTS Safety/tolerability Pharmacokinetics Anti-tumor activity NEXT STEPS Continue escalation PK expansion at 3.6 mg/kg MTD or RP2D Specific expansion

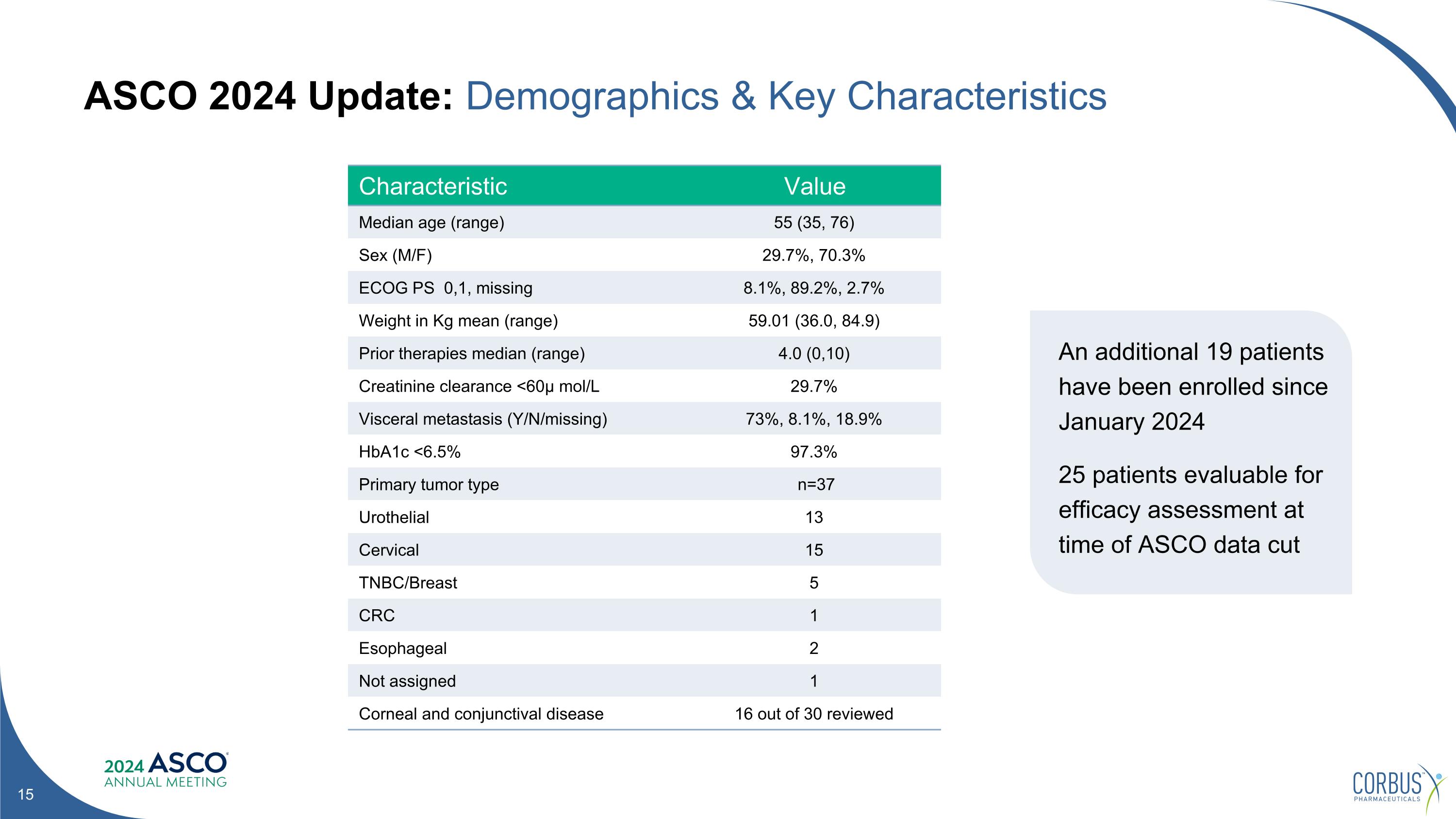

ASCO 2024 Update: Demographics & Key Characteristics Characteristic Value Median age (range) 55 (35, 76) Sex (M/F) 29.7%, 70.3% ECOG PS 0,1, missing 8.1%, 89.2%, 2.7% Weight in Kg mean (range) 59.01 (36.0, 84.9) Prior therapies median (range) 4.0 (0,10) Creatinine clearance <60μ mol/L 29.7% Visceral metastasis (Y/N/missing) 73%, 8.1%, 18.9% HbA1c <6.5% 97.3% Primary tumor type n=37 Urothelial 13 Cervical 15 TNBC/Breast 5 CRC 1 Esophageal 2 Not assigned 1 Corneal and conjunctival disease 16 out of 30 reviewed An additional 19 patients have been enrolled since January 2024 25 patients evaluable for efficacy assessment at time of ASCO data cut

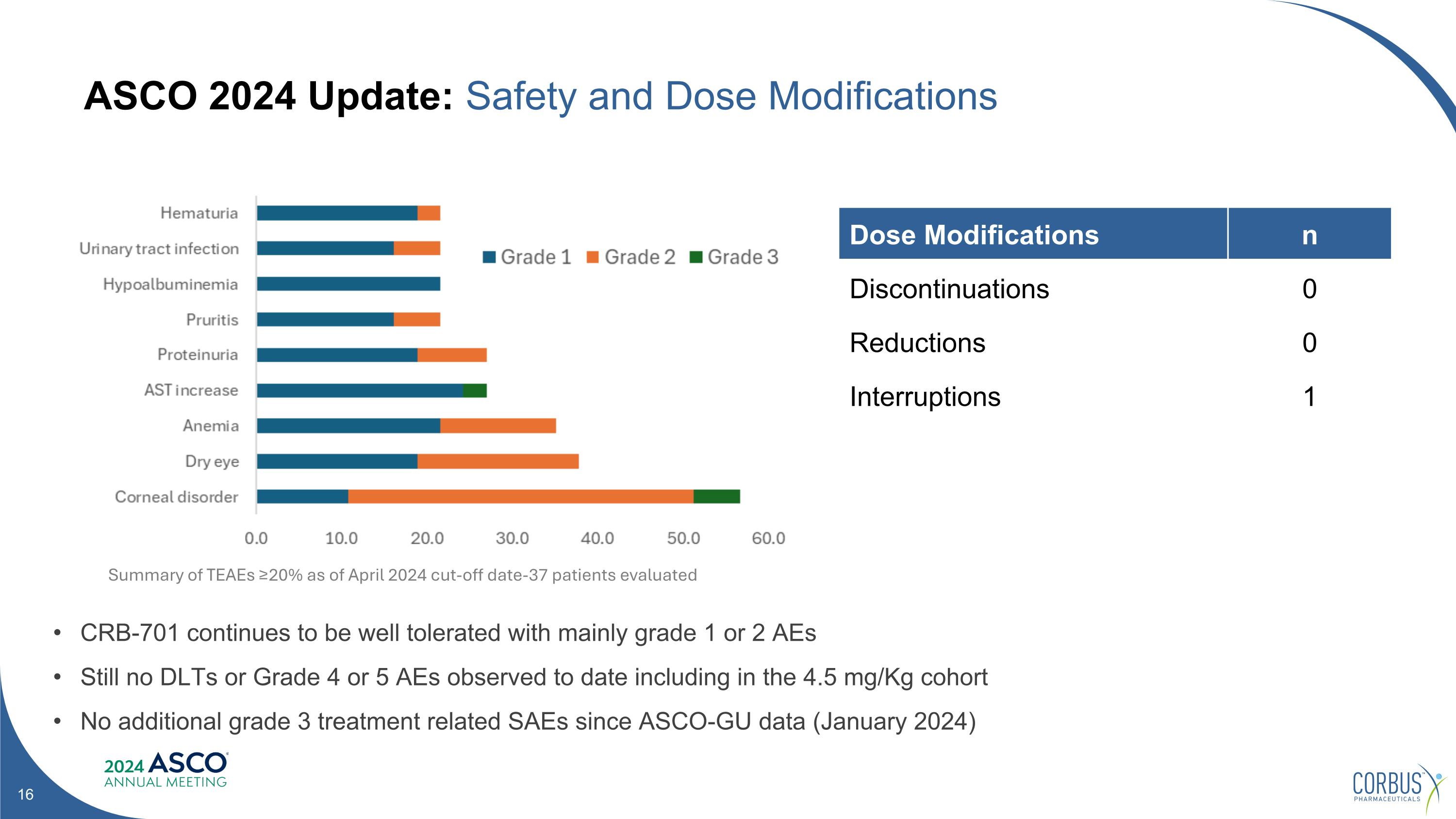

ASCO 2024 Update: Safety and Dose Modifications Dose Modifications n Discontinuations 0 Reductions 0 Interruptions 1 CRB-701 continues to be well tolerated with mainly grade 1 or 2 AEs Still no DLTs or Grade 4 or 5 AEs observed to date including in the 4.5 mg/Kg cohort No additional grade 3 treatment related SAEs since ASCO-GU data (January 2024) Summary of TEAEs ≥20% as of April 2024 cut-off date-37 patients evaluated

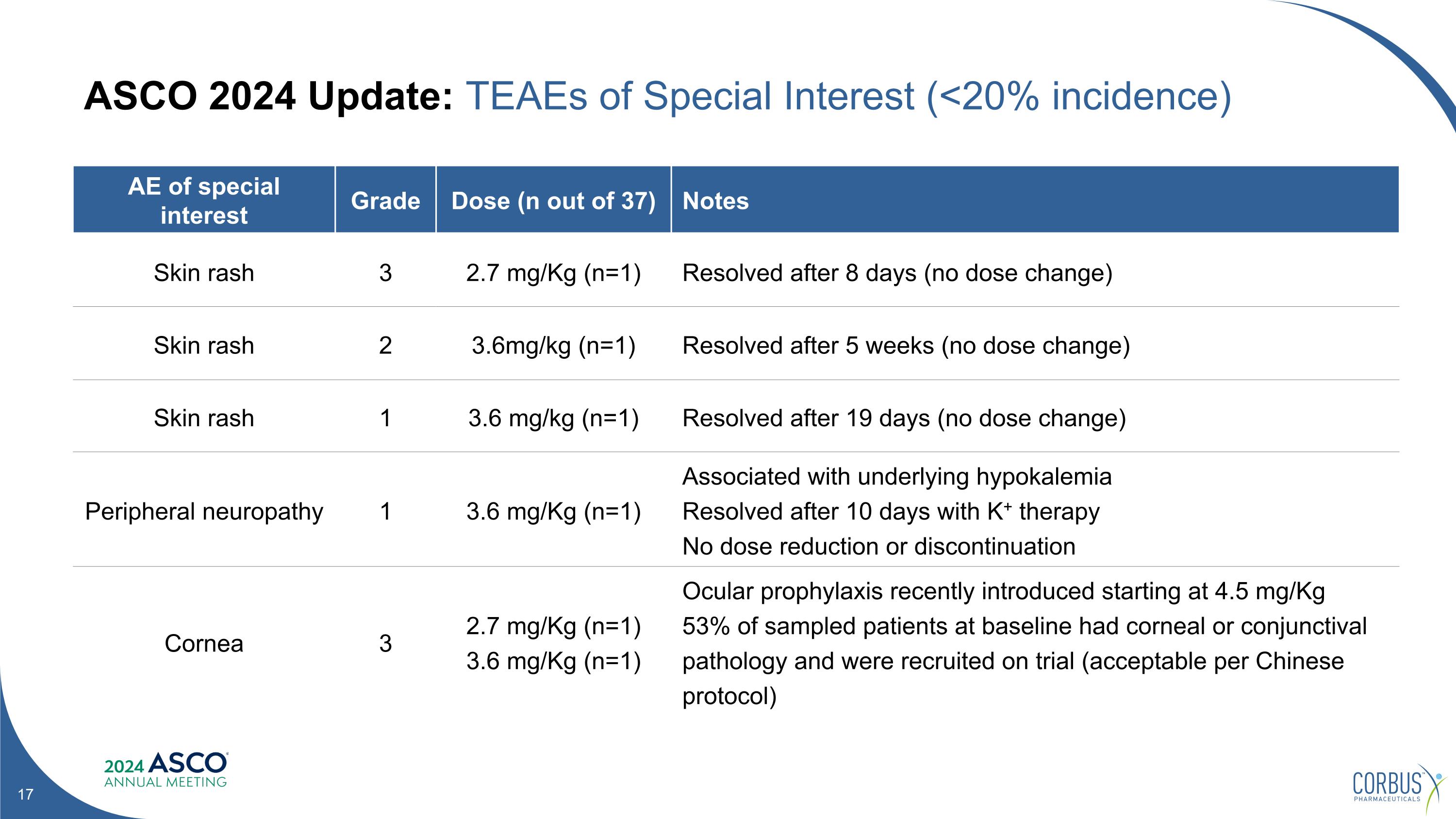

ASCO 2024 Update: TEAEs of Special Interest (<20% incidence) AE of special interest Grade Dose (n out of 37) Notes Skin rash 3 2.7 mg/Kg (n=1) Resolved after 8 days (no dose change) Skin rash 2 3.6mg/kg (n=1) Resolved after 5 weeks (no dose change) Skin rash 1 3.6 mg/kg (n=1) Resolved after 19 days (no dose change) Peripheral neuropathy 1 3.6 mg/Kg (n=1) Associated with underlying hypokalemia Resolved after 10 days with K+ therapy No dose reduction or discontinuation Cornea 3 2.7 mg/Kg (n=1) 3.6 mg/Kg (n=1) Ocular prophylaxis recently introduced starting at 4.5 mg/Kg 53% of sampled patients at baseline had corneal or conjunctival pathology and were recruited on trial (acceptable per Chinese protocol)

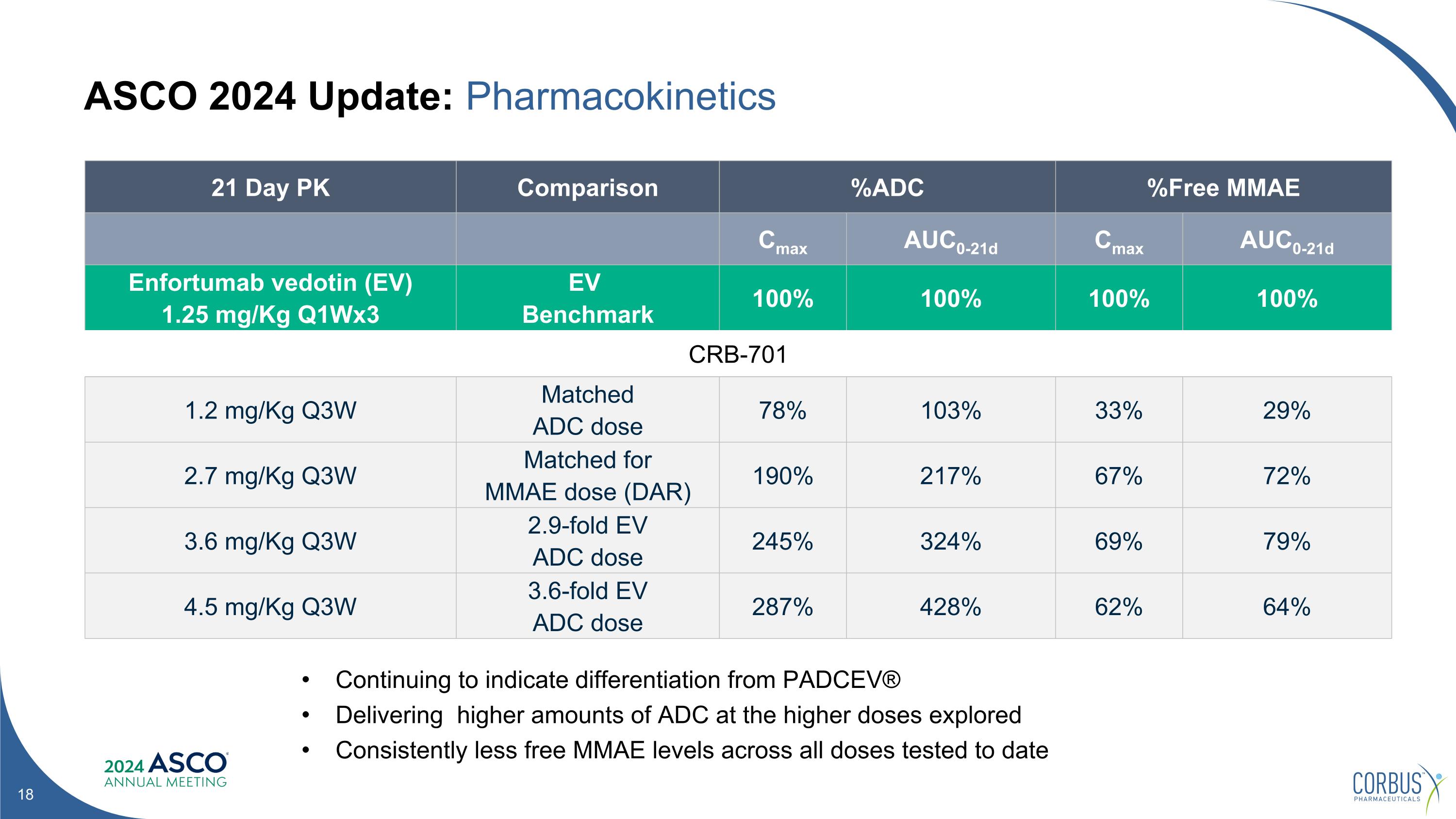

ASCO 2024 Update: Pharmacokinetics Continuing to indicate differentiation from PADCEV® Delivering higher amounts of ADC at the higher doses explored Consistently less free MMAE levels across all doses tested to date 21 Day PK Comparison %ADC %Free MMAE Cmax AUC0-21d Cmax AUC0-21d Enfortumab vedotin (EV) 1.25 mg/Kg Q1Wx3 EV Benchmark 100% 100% 100% 100% CRB-701 1.2 mg/Kg Q3W Matched ADC dose 78% 103% 33% 29% 2.7 mg/Kg Q3W Matched for MMAE dose (DAR) 190% 217% 67% 72% 3.6 mg/Kg Q3W 2.9-fold EV ADC dose 245% 324% 69% 79% 4.5 mg/Kg Q3W 3.6-fold EV ADC dose 287% 428% 62% 64%

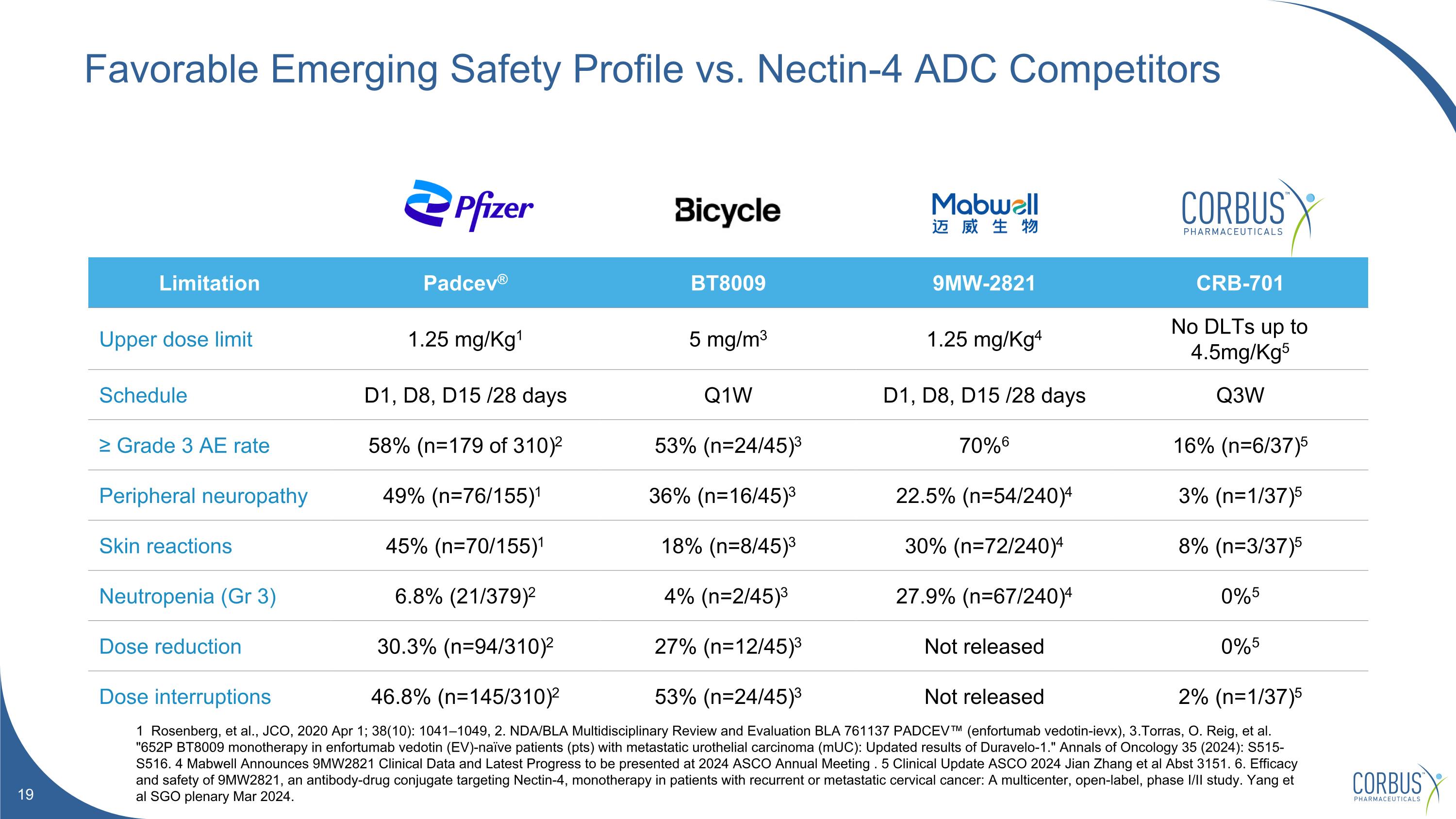

Favorable Emerging Safety Profile vs. Nectin-4 ADC Competitors 1 Rosenberg, et al., JCO, 2020 Apr 1; 38(10): 1041–1049, 2. NDA/BLA Multidisciplinary Review and Evaluation BLA 761137 PADCEV™ (enfortumab vedotin-ievx), 3.Torras, O. Reig, et al. "652P BT8009 monotherapy in enfortumab vedotin (EV)-naïve patients (pts) with metastatic urothelial carcinoma (mUC): Updated results of Duravelo-1." Annals of Oncology 35 (2024): S515-S516. 4 Mabwell Announces 9MW2821 Clinical Data and Latest Progress to be presented at 2024 ASCO Annual Meeting . 5 Clinical Update ASCO 2024 Jian Zhang et al Abst 3151. 6. Efficacy and safety of 9MW2821, an antibody-drug conjugate targeting Nectin-4, monotherapy in patients with recurrent or metastatic cervical cancer: A multicenter, open-label, phase I/II study. Yang et al SGO plenary Mar 2024. Limitation Padcev® BT8009 9MW-2821 CRB-701 Upper dose limit 1.25 mg/Kg1 5 mg/m3 1.25 mg/Kg4 No DLTs up to 4.5mg/Kg5 Schedule D1, D8, D15 /28 days Q1W D1, D8, D15 /28 days Q3W ≥ Grade 3 AE rate 58% (n=179 of 310)2 53% (n=24/45)3 70%6 16% (n=6/37)5 Peripheral neuropathy 49% (n=76/155)1 36% (n=16/45)3 22.5% (n=54/240)4 3% (n=1/37)5 Skin reactions 45% (n=70/155)1 18% (n=8/45)3 30% (n=72/240)4 8% (n=3/37)5 Neutropenia (Gr 3) 6.8% (21/379)2 4% (n=2/45)3 27.9% (n=67/240)4 0%5 Dose reduction 30.3% (n=94/310)2 27% (n=12/45)3 Not released 0%5 Dose interruptions 46.8% (n=145/310)2 53% (n=24/45)3 Not released 2% (n=1/37)5

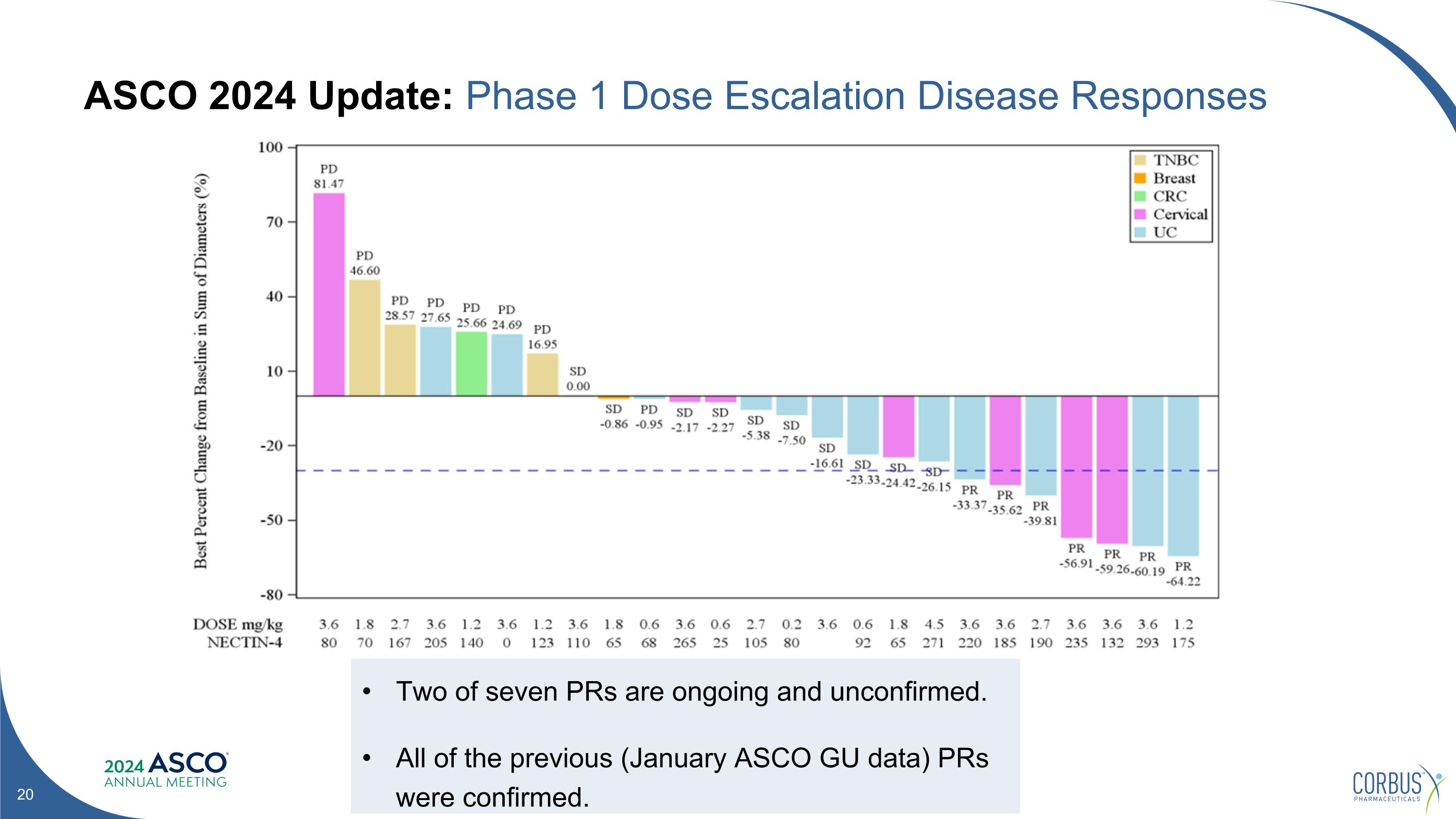

ASCO 2024 Update: Phase 1 Dose Escalation Disease Responses Two of seven PRs are ongoing and unconfirmed. All of the previous (January ASCO GU data) PRs were confirmed.

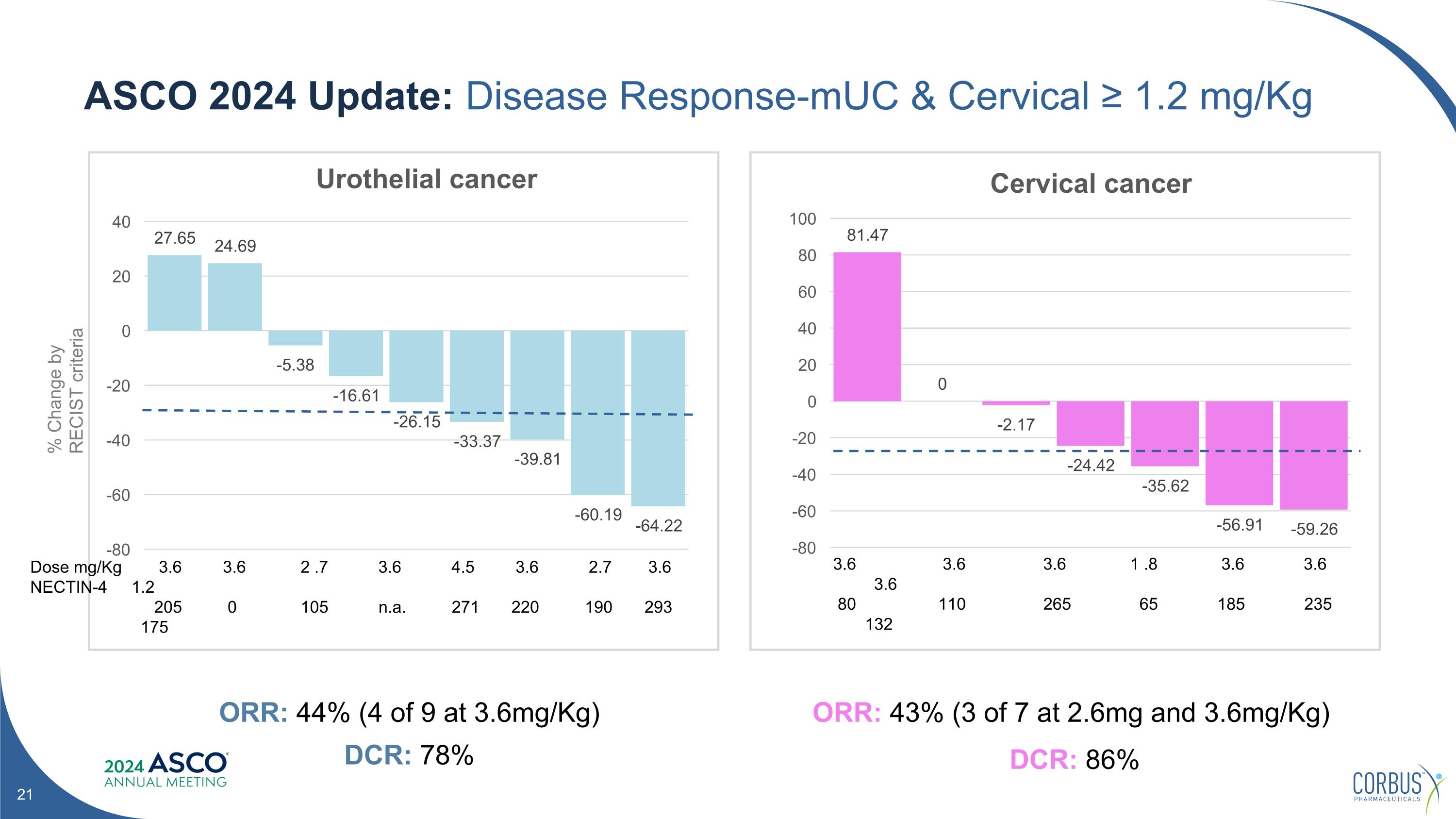

ASCO 2024 Update: Disease Response-mUC & Cervical ≥ 1.2 mg/Kg ORR: 43% (3 of 7 at 2.6mg and 3.6mg/Kg) DCR: 86% ORR: 44% (4 of 9 at 3.6mg/Kg) DCR: 78% % Change by RECIST criteria Dose mg/Kg NECTIN-4 3.6 3.6 2 .7 3.6 4.5 3.6 2.7 3.6 1.2 205 0 105 n.a. 271 220 190 293 175 3.6 3.6 3.6 1 .8 3.6 3.6 3.6 80 110 265 65 185 235 132

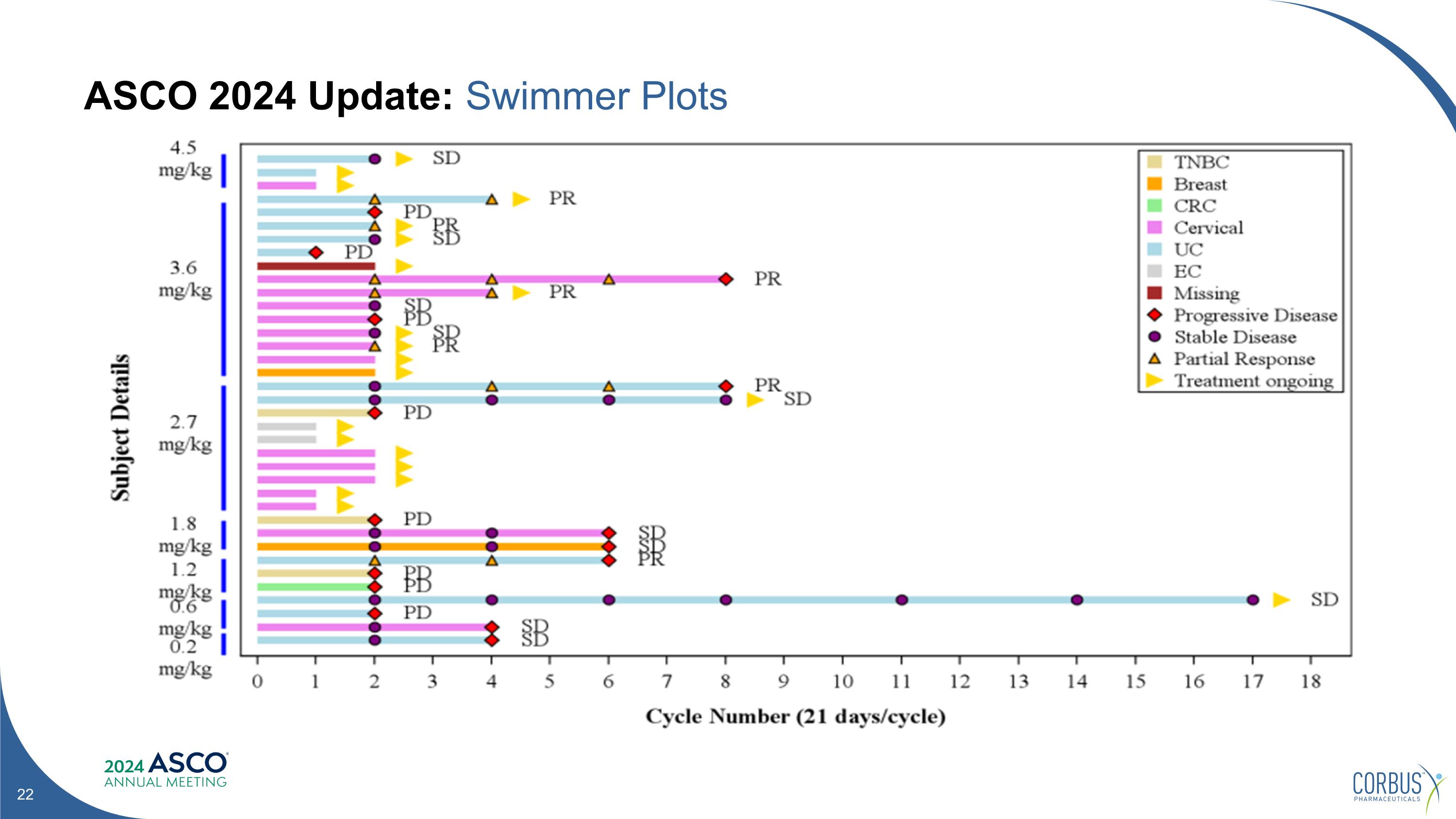

ASCO 2024 Update: Swimmer Plots

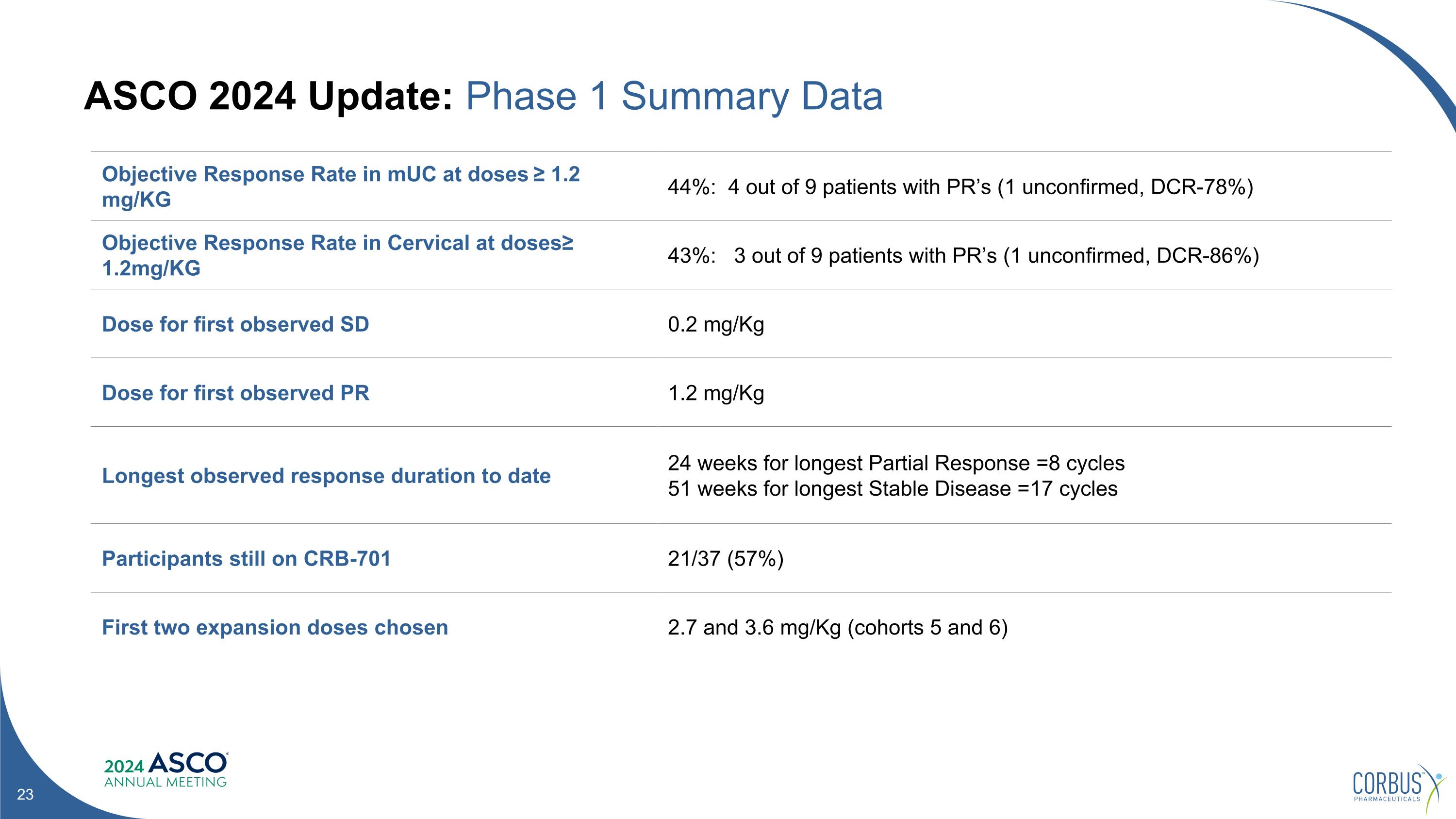

ASCO 2024 Update: Phase 1 Summary Data Objective Response Rate in mUC at doses ≥ 1.2 mg/KG 44%: 4 out of 9 patients with PR’s (1 unconfirmed, DCR-78%) Objective Response Rate in Cervical at doses≥ 1.2mg/KG 43%: 3 out of 9 patients with PR’s (1 unconfirmed, DCR-86%) Dose for first observed SD 0.2 mg/Kg Dose for first observed PR 1.2 mg/Kg Longest observed response duration to date 24 weeks for longest Partial Response =8 cycles 51 weeks for longest Stable Disease =17 cycles Participants still on CRB-701 21/37 (57%) First two expansion doses chosen 2.7 and 3.6 mg/Kg (cohorts 5 and 6)

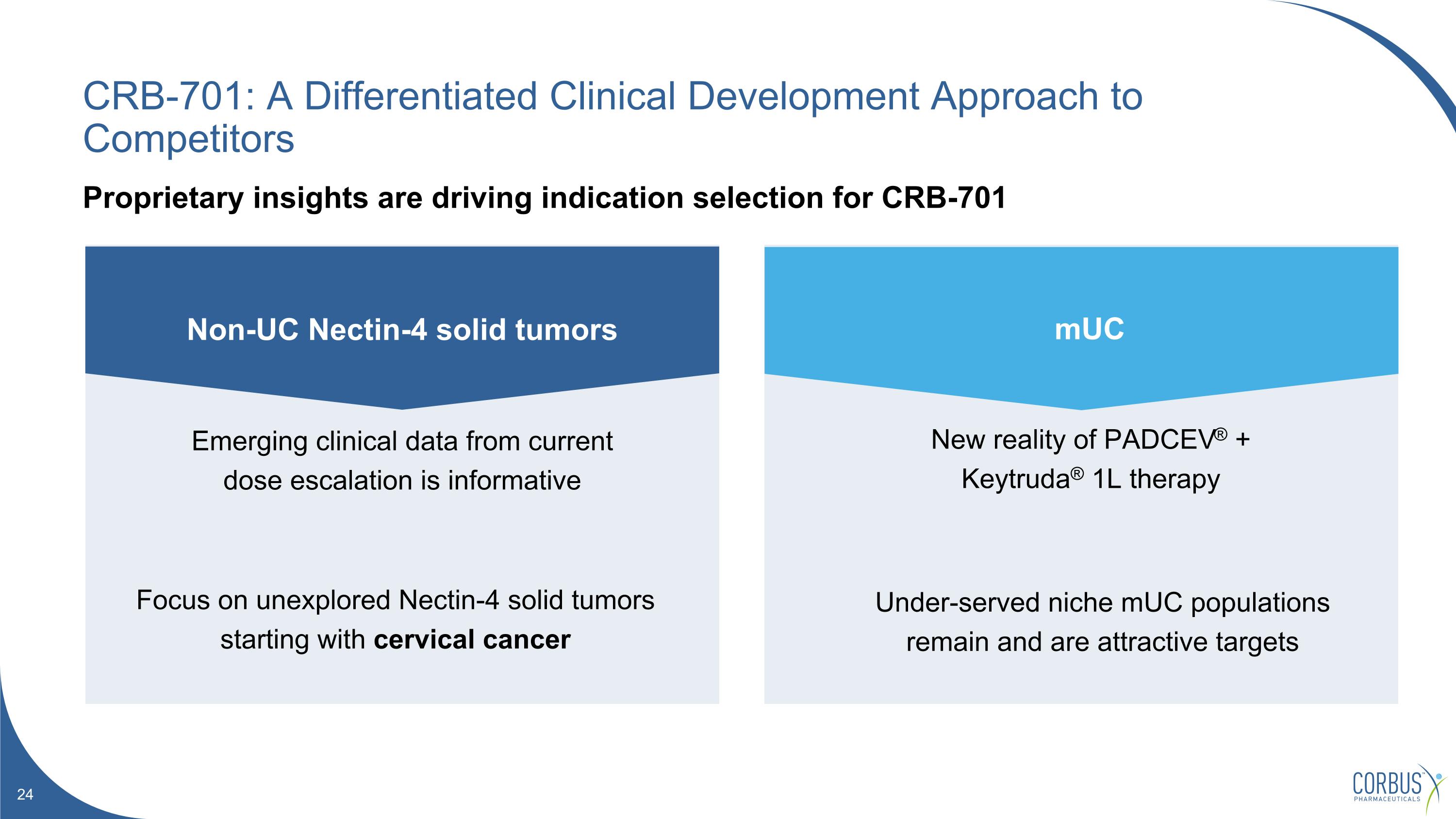

CRB-701: A Differentiated Clinical Development Approach to Competitors Proprietary insights are driving indication selection for CRB-701 New reality of PADCEV® + Keytruda® 1L therapy Under-served niche mUC populations remain and are attractive targets Emerging clinical data from current dose escalation is informative Focus on unexplored Nectin-4 solid tumors starting with cervical cancer Non-UC Nectin-4 solid tumors mUC

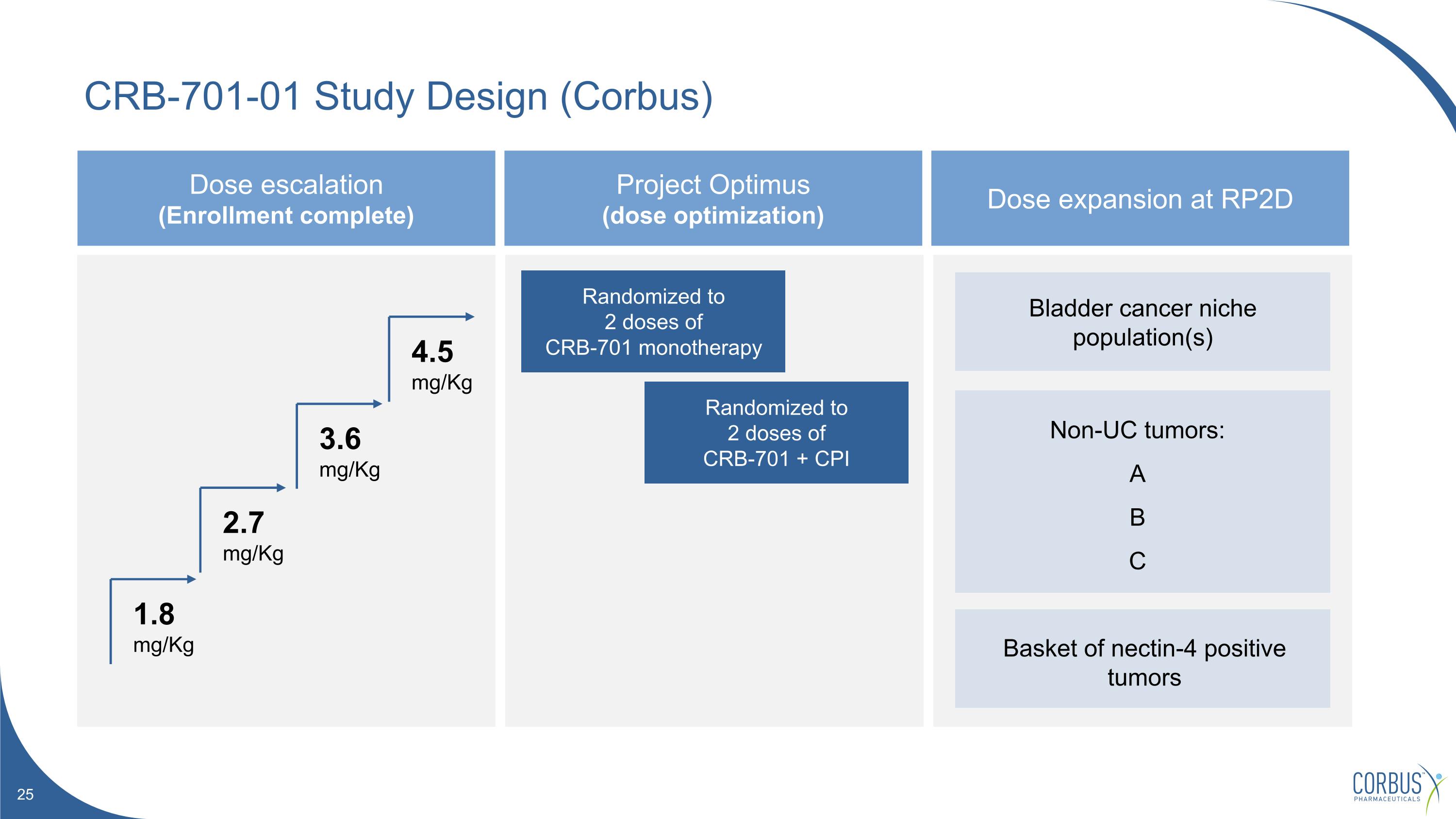

CRB-701-01 Study Design (Corbus) Dose escalation (Enrollment complete) Project Optimus (dose optimization) Dose expansion at RP2D Randomized to 2 doses of CRB-701 monotherapy Randomized to 2 doses of CRB-701 + CPI 1.8 mg/Kg 2.7 mg/Kg 3.6 mg/Kg 4.5 mg/Kg Bladder cancer niche population(s) Non-UC tumors: A B C Basket of nectin-4 positive tumors

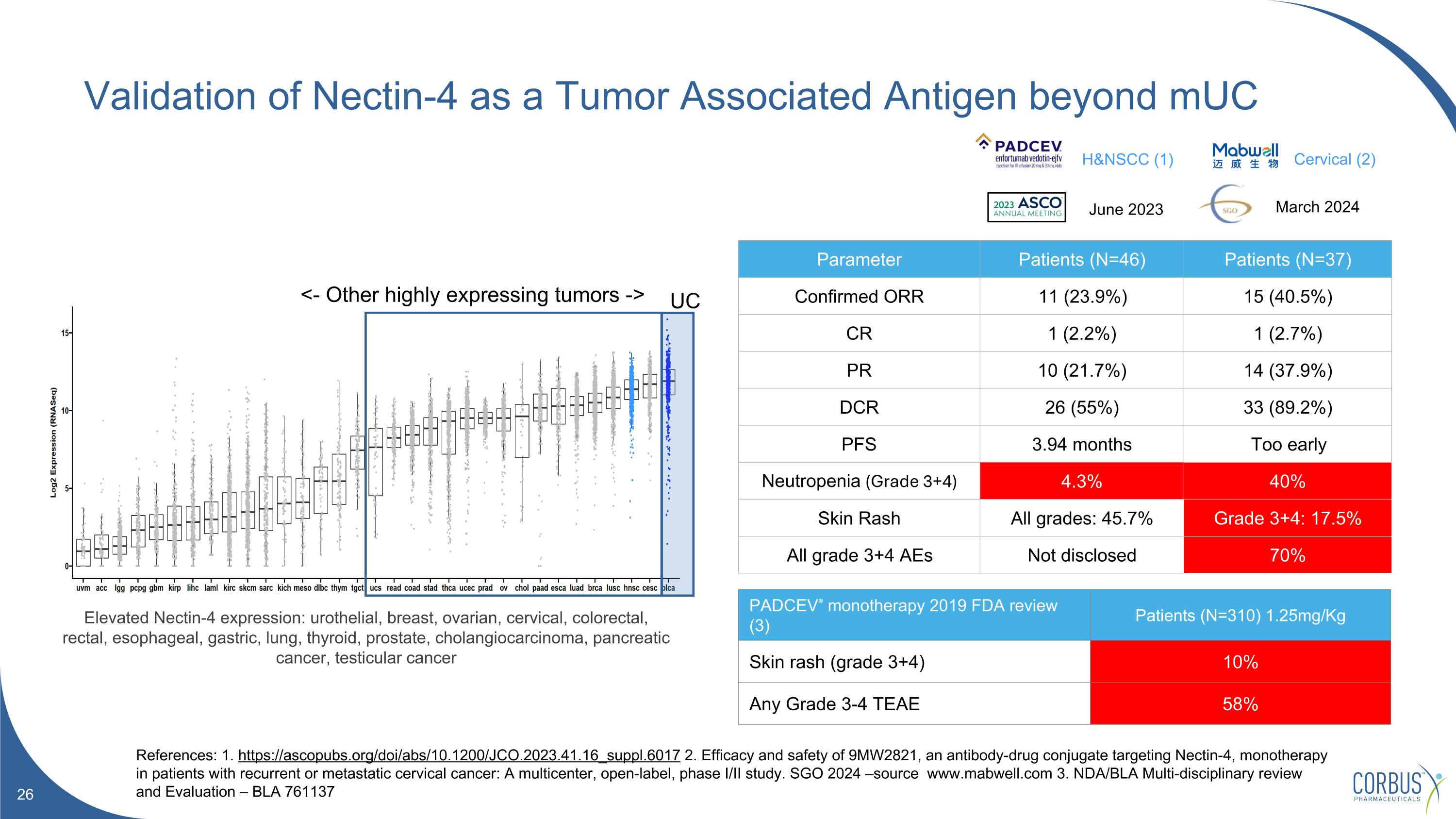

Validation of Nectin-4 as a Tumor Associated Antigen beyond mUC References: 1. https://ascopubs.org/doi/abs/10.1200/JCO.2023.41.16_suppl.6017 2. Efficacy and safety of 9MW2821, an antibody-drug conjugate targeting Nectin-4, monotherapy in patients with recurrent or metastatic cervical cancer: A multicenter, open-label, phase I/II study. SGO 2024 –source www.mabwell.com 3. NDA/BLA Multi-disciplinary review and Evaluation – BLA 761137 Parameter Patients (N=46) Patients (N=37) Confirmed ORR 11 (23.9%) 15 (40.5%) CR 1 (2.2%) 1 (2.7%) PR 10 (21.7%) 14 (37.9%) DCR 26 (55%) 33 (89.2%) PFS 3.94 months Too early Neutropenia (Grade 3+4) 4.3% 40% Skin Rash All grades: 45.7% Grade 3+4: 17.5% All grade 3+4 AEs Not disclosed 70% Elevated Nectin-4 expression: urothelial, breast, ovarian, cervical, colorectal, rectal, esophageal, gastric, lung, thyroid, prostate, cholangiocarcinoma, pancreatic cancer, testicular cancer <- Other highly expressing tumors -> UC H&NSCC (1) Cervical (2) March 2024 PADCEV® monotherapy 2019 FDA review (3) Patients (N=310) 1.25mg/Kg Skin rash (grade 3+4) 10% Any Grade 3-4 TEAE 58% June 2023

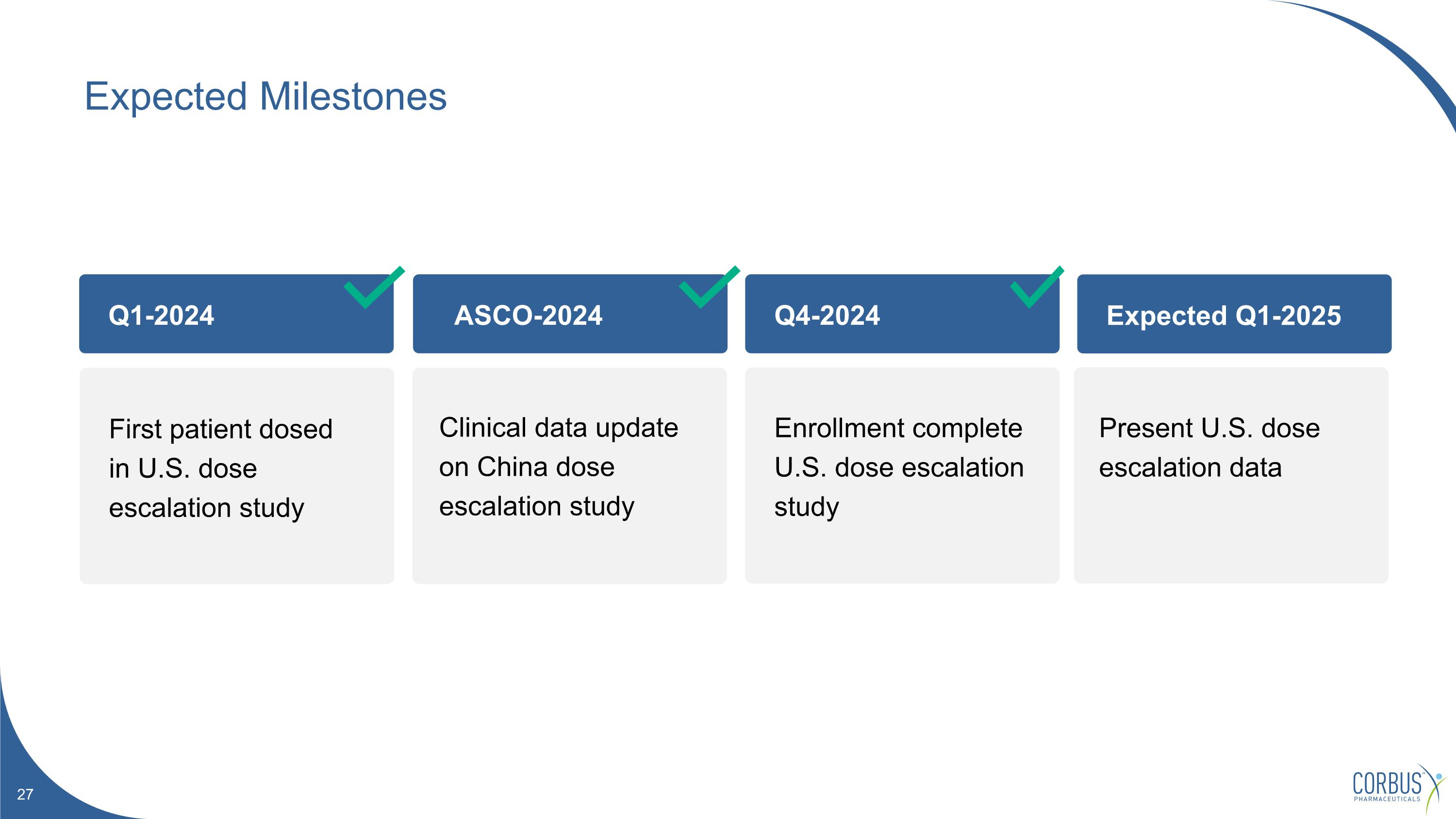

ASCO-2024 Q4-2024 Expected Q1-2025 Expected Milestones Q1-2024 First patient dosed in U.S. dose escalation study Clinical data update on China dose escalation study Enrollment complete U.S. dose escalation study Present U.S. dose escalation data

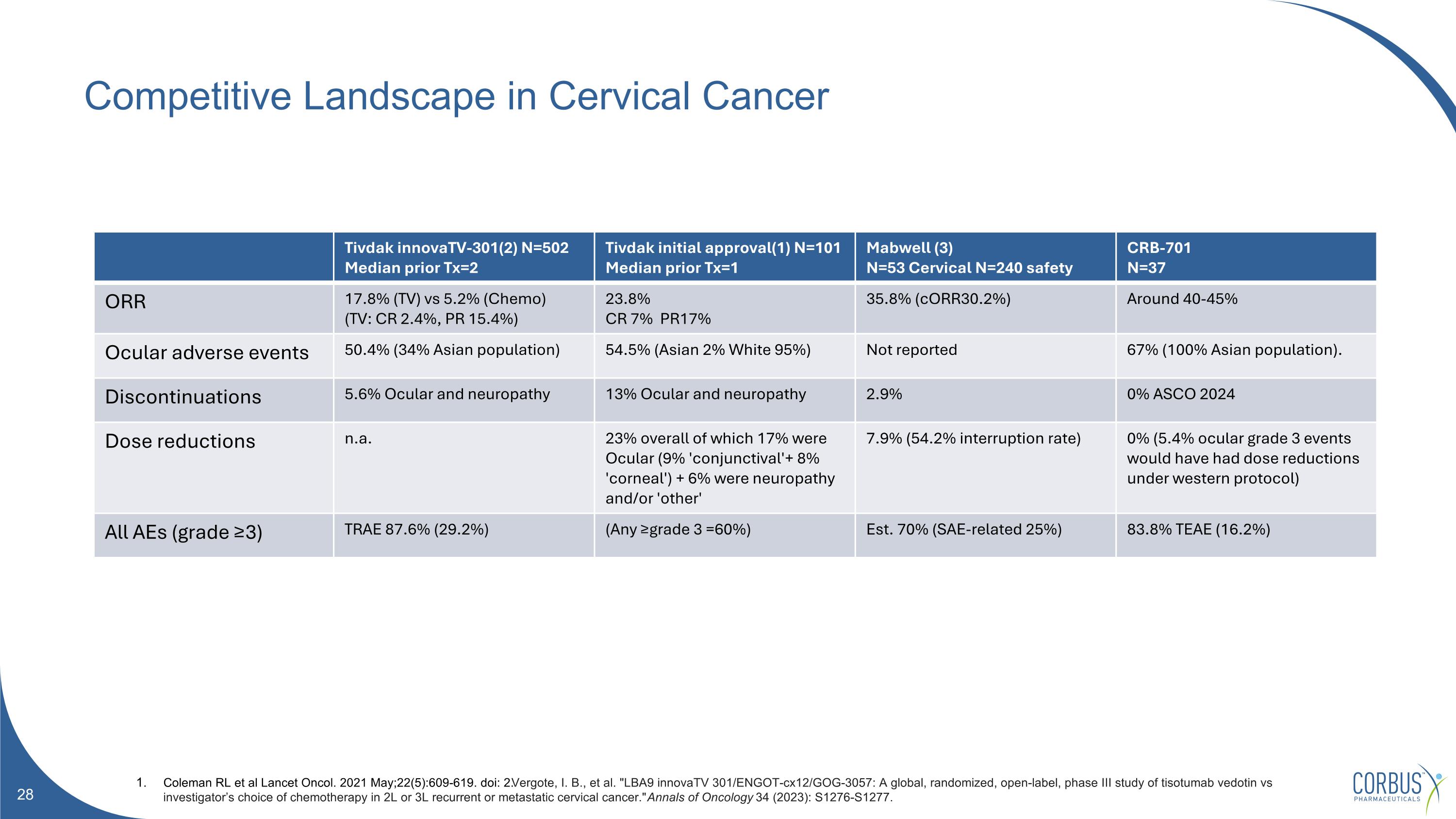

Competitive Landscape in Cervical Cancer Tivdak innovaTV-301(2) N=502 Median prior Tx=2 Tivdak initial approval(1) N=101 Median prior Tx=1 Mabwell (3) N=53 Cervical N=240 safety CRB-701 N=37 ORR 17.8% (TV) vs 5.2% (Chemo) (TV: CR 2.4%, PR 15.4%) 23.8% CR 7% PR17% 35.8% (cORR30.2%) Around 40-45% Ocular adverse events 50.4% (34% Asian population) 54.5% (Asian 2% White 95%) Not reported 67% (100% Asian population). Discontinuations 5.6% Ocular and neuropathy 13% Ocular and neuropathy 2.9% 0% ASCO 2024 Dose reductions n.a. 23% overall of which 17% were Ocular (9% 'conjunctival'+ 8% 'corneal') + 6% were neuropathy and/or 'other' 7.9% (54.2% interruption rate) 0% (5.4% ocular grade 3 events would have had dose reductions under western protocol) All AEs (grade ≥3) TRAE 87.6% (29.2%) (Any ≥grade 3 =60%) Est. 70% (SAE-related 25%) 83.8% TEAE (16.2%) Coleman RL et al Lancet Oncol. 2021 May;22(5):609-619. doi: 2.Vergote, I. B., et al. "LBA9 innovaTV 301/ENGOT-cx12/GOG-3057: A global, randomized, open-label, phase III study of tisotumab vedotin vs investigator’s choice of chemotherapy in 2L or 3L recurrent or metastatic cervical cancer." Annals of Oncology 34 (2023): S1276-S1277.

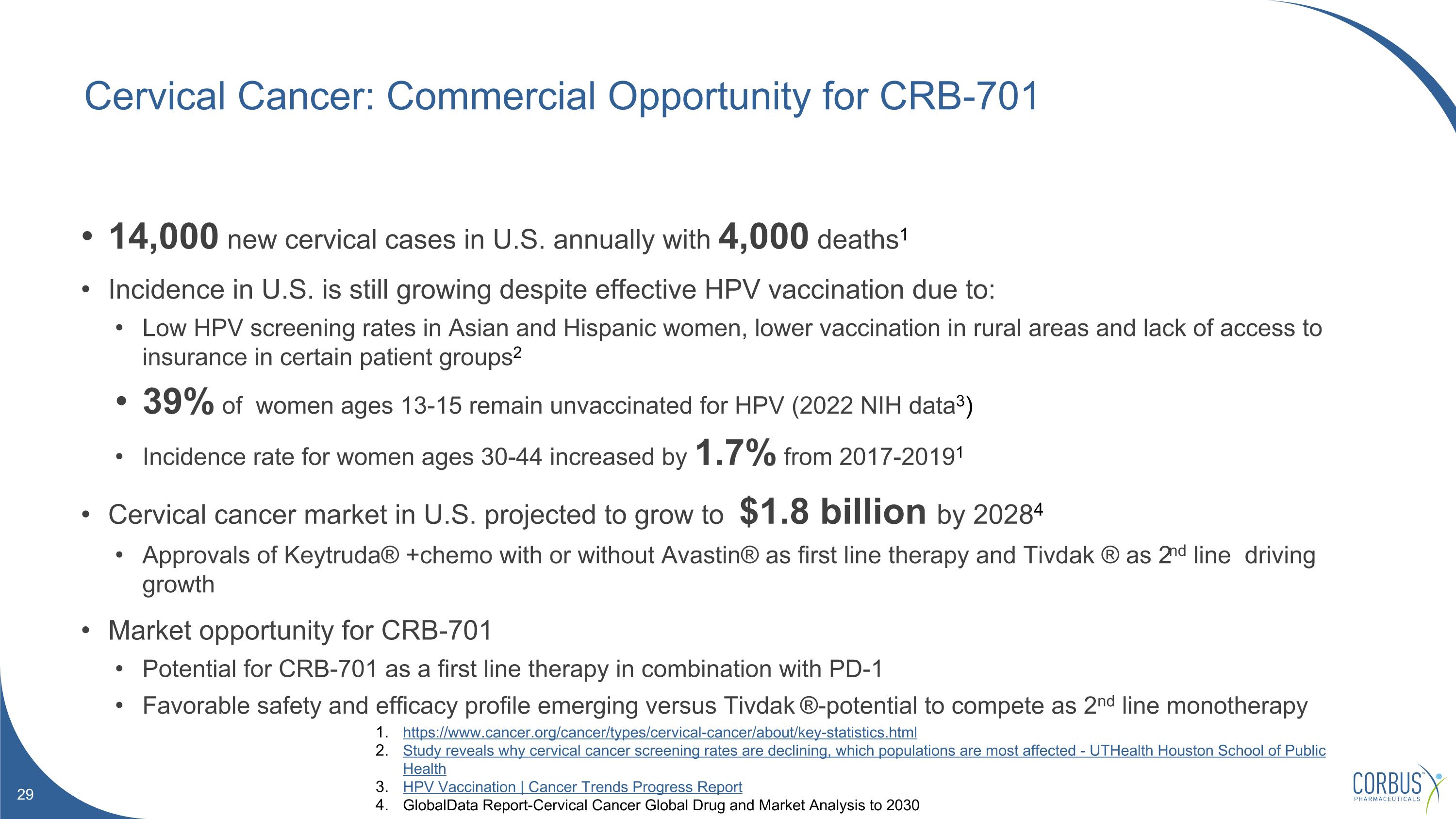

Cervical Cancer: Commercial Opportunity for CRB-701 14,000 new cervical cases in U.S. annually with 4,000 deaths1 Incidence in U.S. is still growing despite effective HPV vaccination due to: Low HPV screening rates in Asian and Hispanic women, lower vaccination in rural areas and lack of access to insurance in certain patient groups2 39% of women ages 13-15 remain unvaccinated for HPV (2022 NIH data3) Incidence rate for women ages 30-44 increased by 1.7% from 2017-20191 Cervical cancer market in U.S. projected to grow to $1.8 billion by 20284 Approvals of Keytruda® +chemo with or without Avastin® as first line therapy and Tivdak ® as 2nd line driving growth Market opportunity for CRB-701 Potential for CRB-701 as a first line therapy in combination with PD-1 Favorable safety and efficacy profile emerging versus Tivdak ®-potential to compete as 2nd line monotherapy https://www.cancer.org/cancer/types/cervical-cancer/about/key-statistics.html Study reveals why cervical cancer screening rates are declining, which populations are most affected - UTHealth Houston School of Public Health HPV Vaccination | Cancer Trends Progress Report GlobalData Report-Cervical Cancer Global Drug and Market Analysis to 2030

CRB-701: Summary Emerging clinical safety appears differentiated to PADCEV® Clinical activity seen in mUC and cervical cancer patients 3rd generation ADC with improved linker stability, reduces MMAE in circulation

CRB-913 Oral cannabinoid Type-1 inverse agonist for superior incretin therapy in obesity

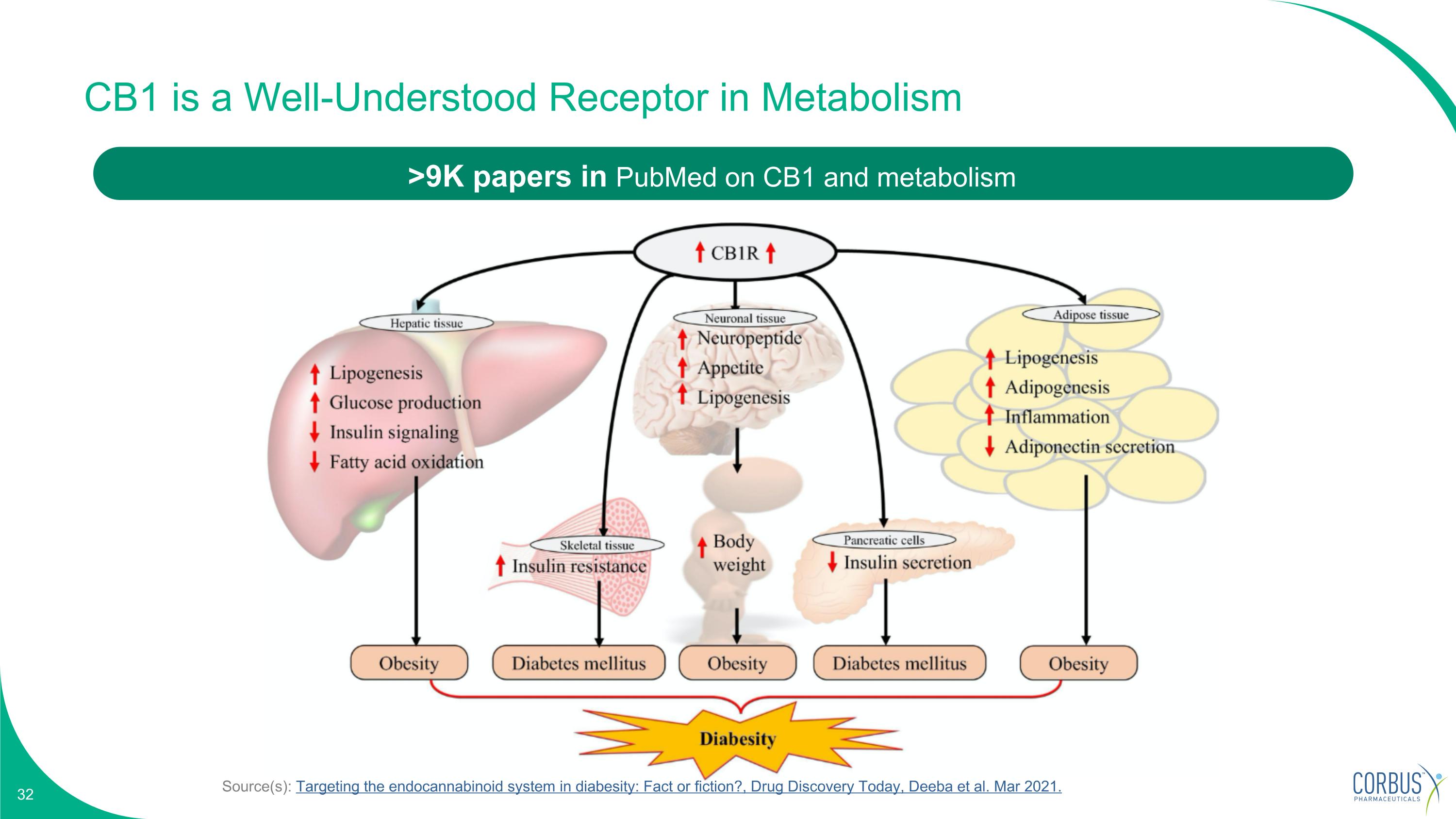

Source(s): Targeting the endocannabinoid system in diabesity: Fact or fiction?, Drug Discovery Today, Deeba et al. Mar 2021. CB1 is a Well-Understood Receptor in Metabolism >9K papers in PubMed on CB1 and metabolism

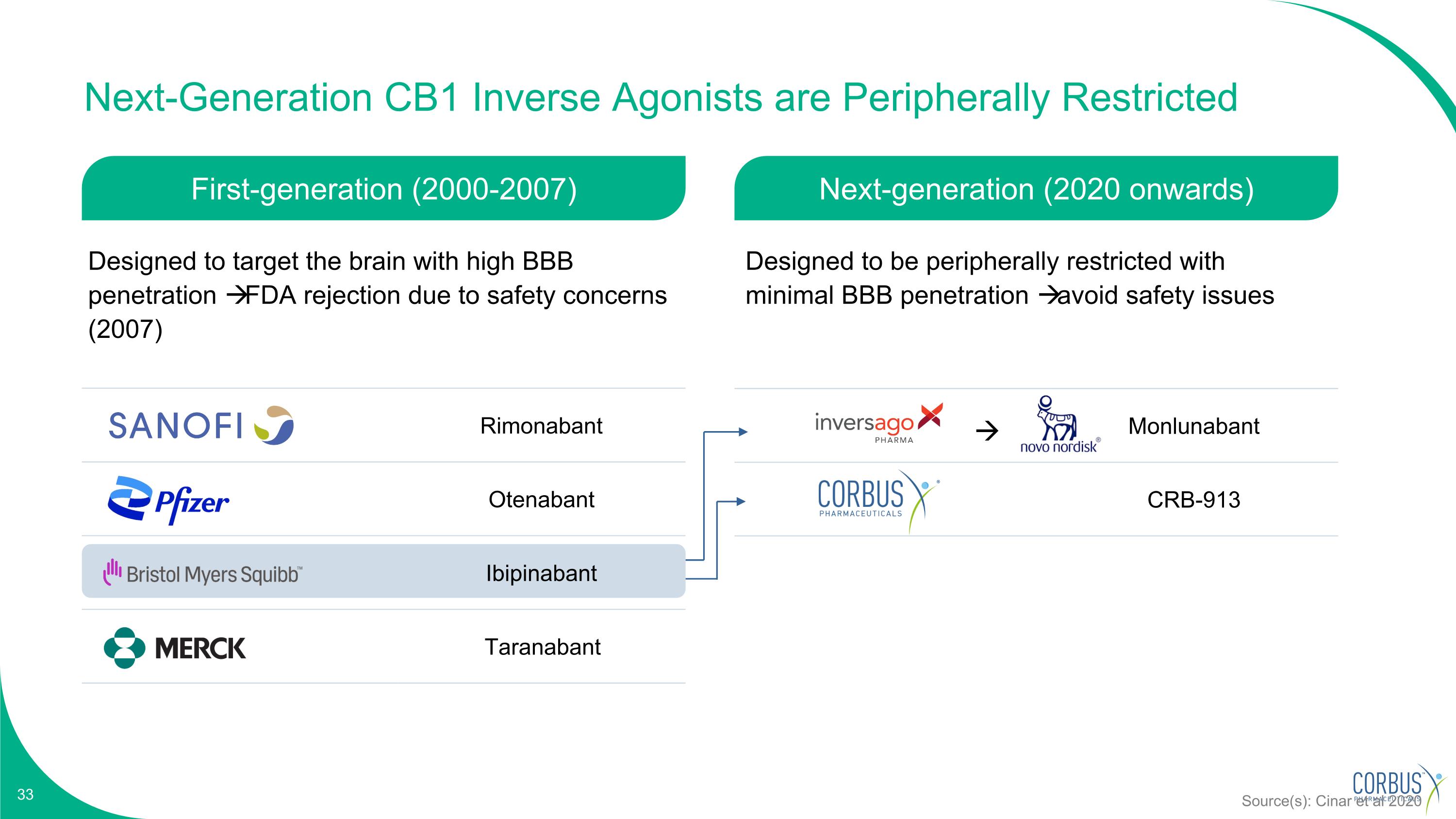

Monlunabant CRB-913 Next-Generation CB1 Inverse Agonists are Peripherally Restricted Rimonabant Otenabant Ibipinabant Taranabant Source(s): Cinar et al 2020 First-generation (2000-2007) Next-generation (2020 onwards) Designed to target the brain with high BBB penetration FDA rejection due to safety concerns (2007) Designed to be peripherally restricted with minimal BBB penetration avoid safety issues

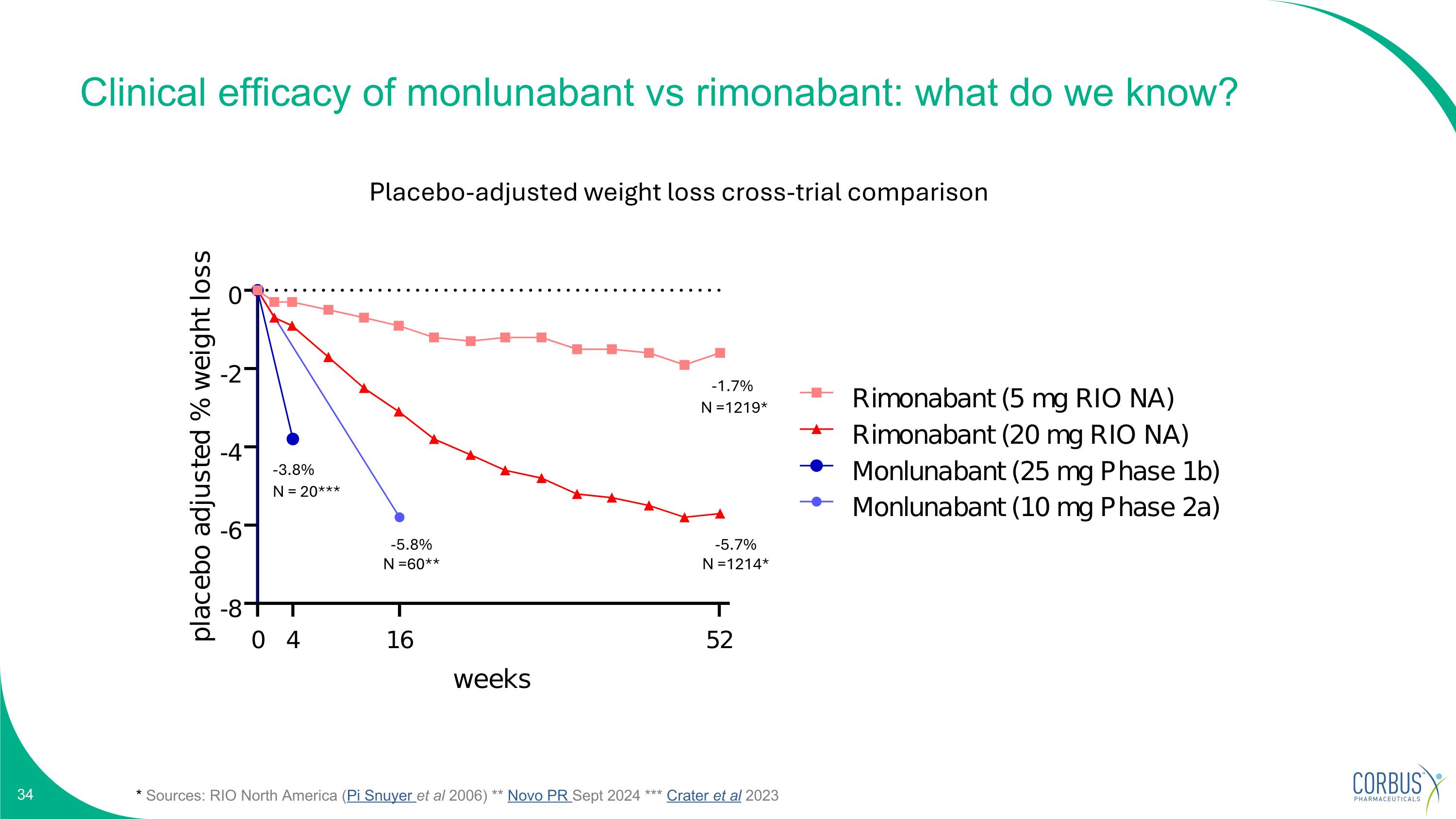

Clinical efficacy of monlunabant vs rimonabant: what do we know? * Sources: RIO North America (Pi Snuyer et al 2006) ** Novo PR Sept 2024 *** Crater et al 2023 N =1214* N =60** N = 20*** Placebo-adjusted weight loss cross-trial comparison N =1219* -5.7% -1.7% -5.8% -3.8%

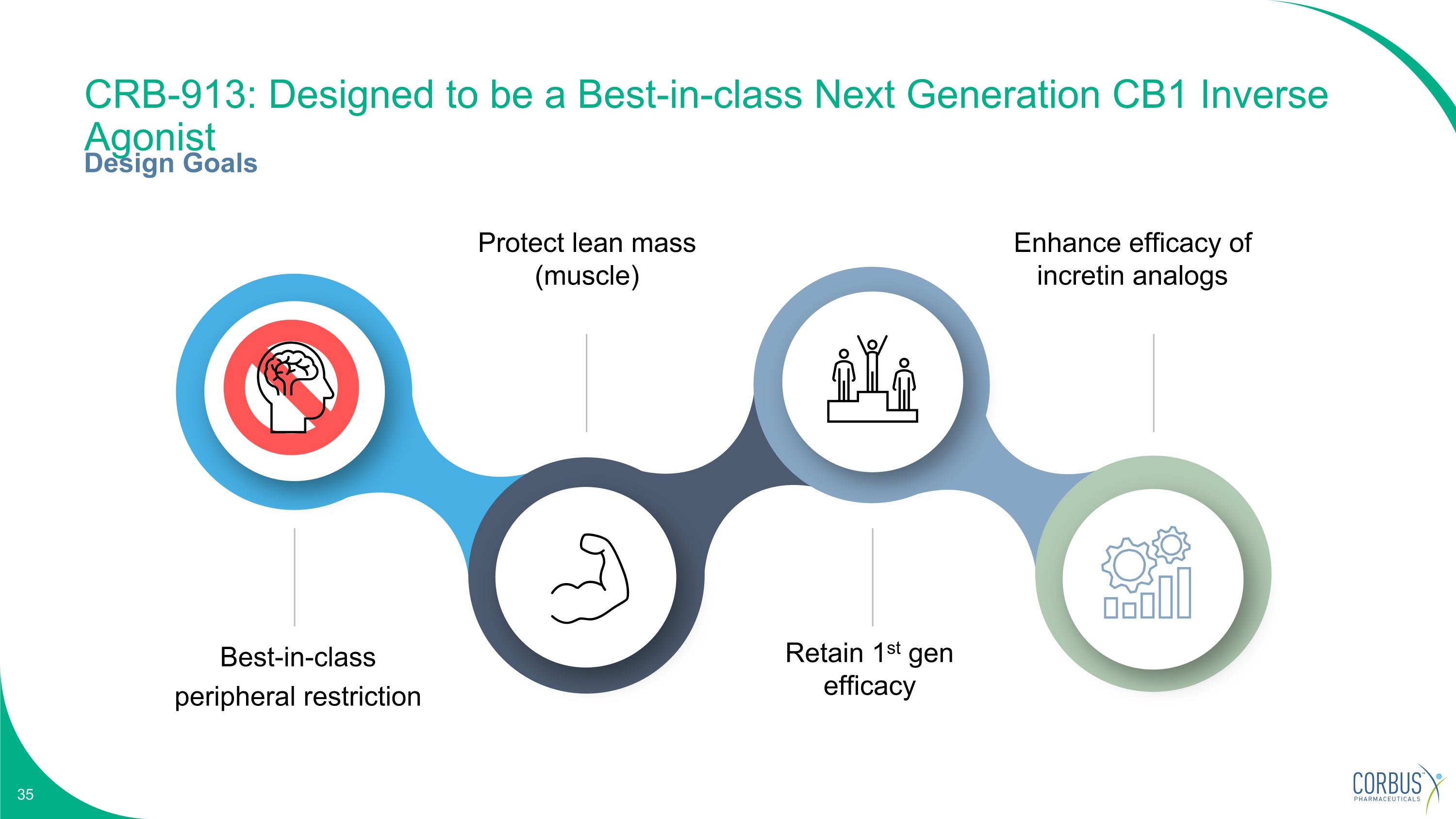

CRB-913: Designed to be a Best-in-class Next Generation CB1 Inverse Agonist Design Goals Best-in-class peripheral restriction Protect lean mass (muscle) Retain 1st gen efficacy Enhance efficacy of incretin analogs

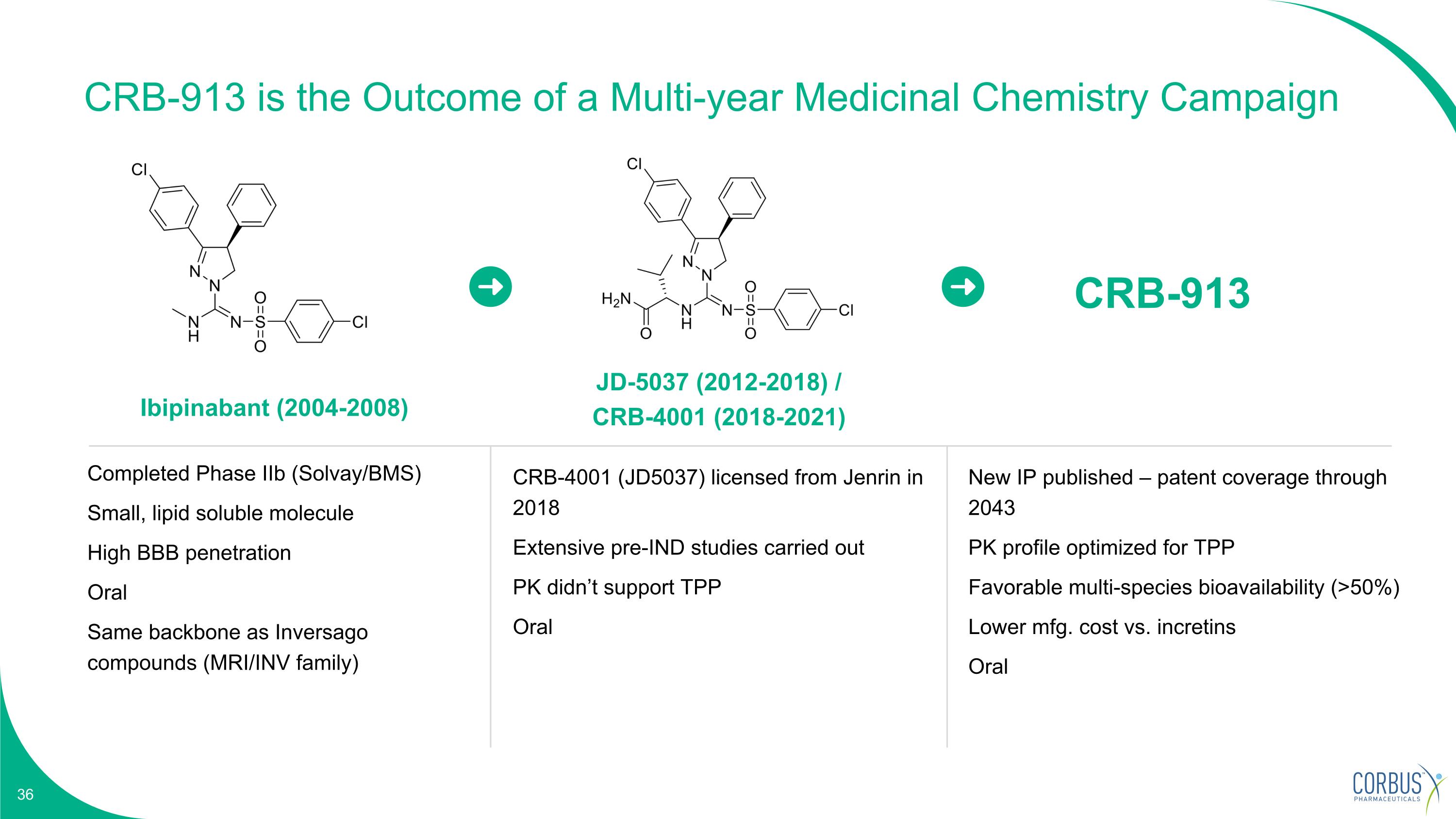

Ibipinabant (2004-2008) JD-5037 (2012-2018) / CRB-4001 (2018-2021) Completed Phase IIb (Solvay/BMS) Small, lipid soluble molecule High BBB penetration Oral Same backbone as Inversago compounds (MRI/INV family) CRB-4001 (JD5037) licensed from Jenrin in 2018 Extensive pre-IND studies carried out PK didn’t support TPP Oral CRB-913 New IP published – patent coverage through 2043 PK profile optimized for TPP Favorable multi-species bioavailability (>50%) Lower mfg. cost vs. incretins Oral CRB-913 is the Outcome of a Multi-year Medicinal Chemistry Campaign

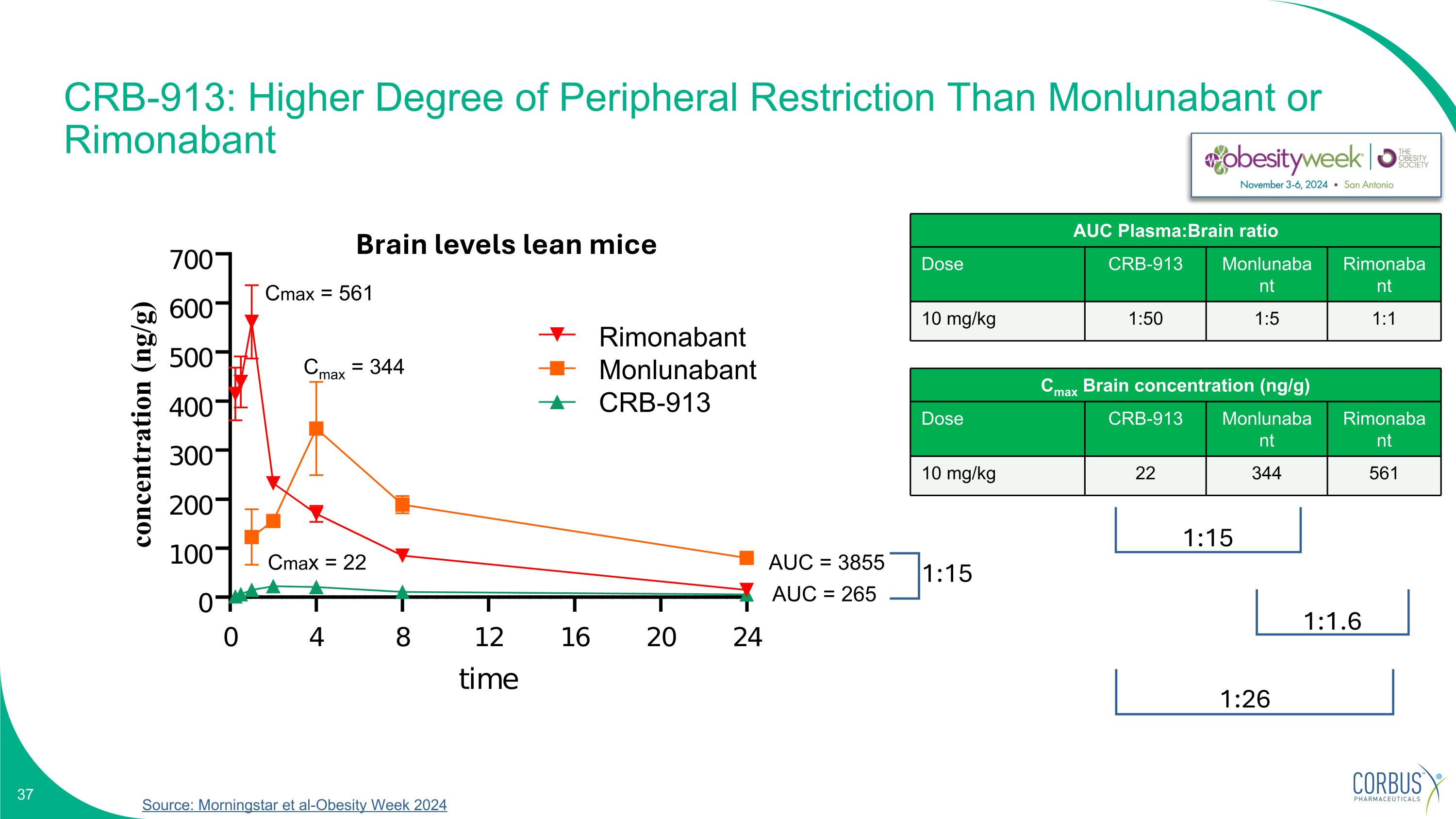

CRB-913: Higher Degree of Peripheral Restriction Than Monlunabant or Rimonabant Cmax = 561 Cmax = 344 Cmax = 22 AUC = 3855 AUC = 265 Cmax Brain concentration (ng/g) Dose CRB-913 Monlunabant Rimonabant 10 mg/kg 22 344 561 1:15 1:26 1:1.6 1:15 AUC Plasma:Brain ratio Dose CRB-913 Monlunabant Rimonabant 10 mg/kg 1:50 1:5 1:1 Brain levels lean mice Rimonabant Monlunabant CRB-913 Source: Morningstar et al-Obesity Week 2024

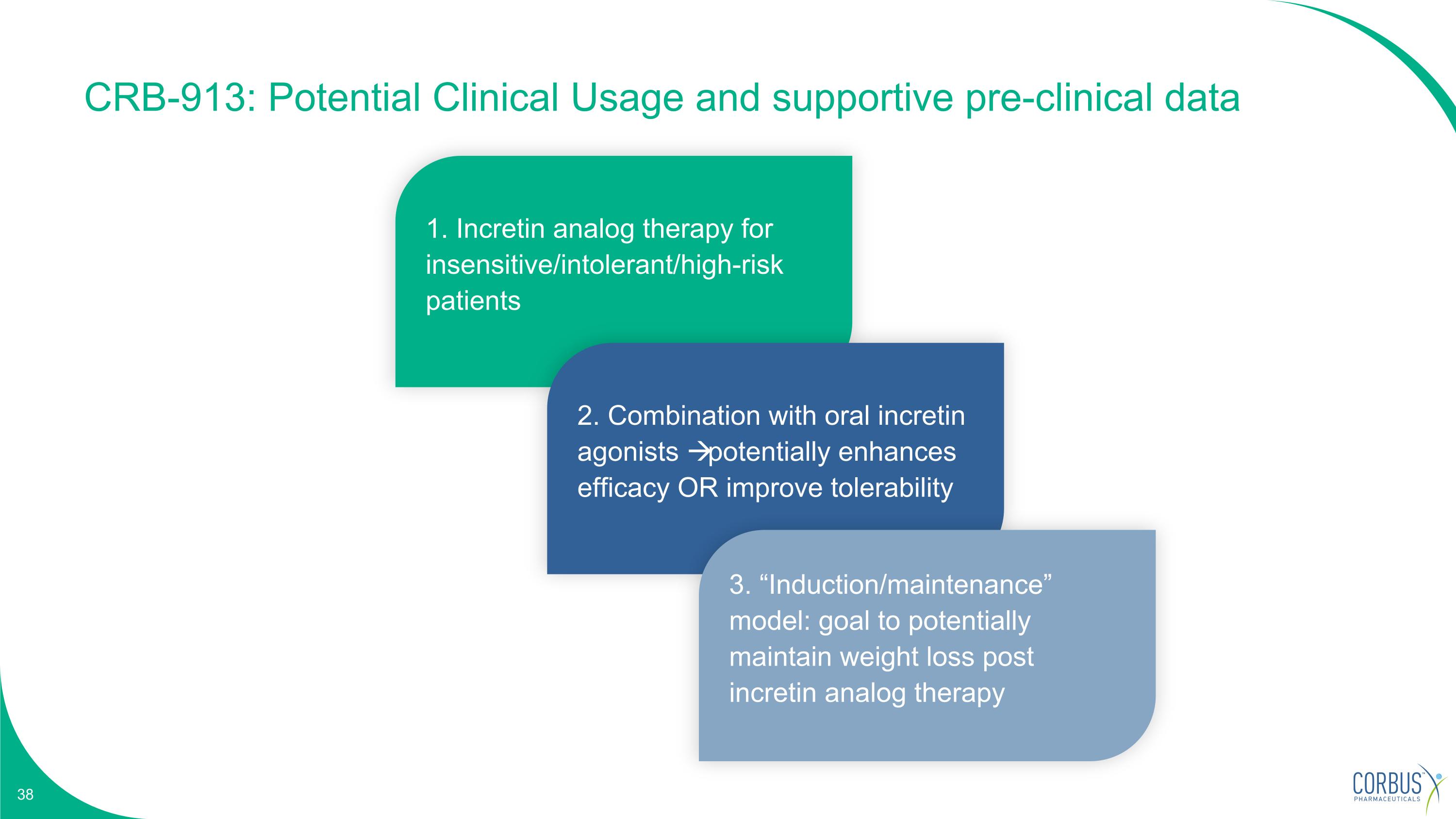

1. Incretin analog therapy for insensitive/intolerant/high-risk patients 2. Combination with oral incretin agonists potentially enhances efficacy OR improve tolerability 3. “Induction/maintenance” model: goal to potentially maintain weight loss post incretin analog therapy CRB-913: Potential Clinical Usage and supportive pre-clinical data

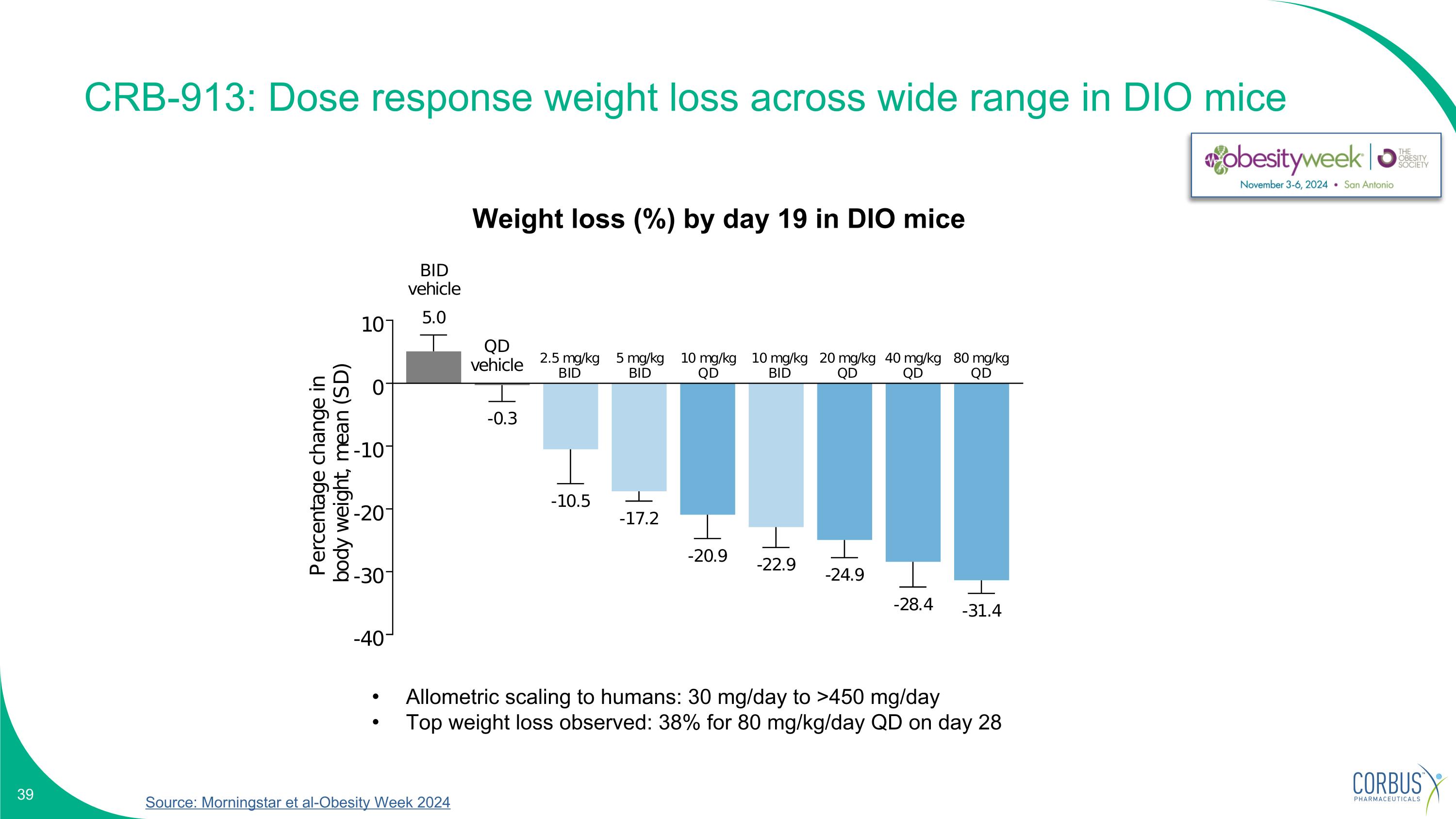

Source: Morningstar et al-Obesity Week 2024 CRB-913: Dose response weight loss across wide range in DIO mice Allometric scaling to humans: 30 mg/day to >450 mg/day Top weight loss observed: 38% for 80 mg/kg/day QD on day 28 Weight loss (%) by day 19 in DIO mice

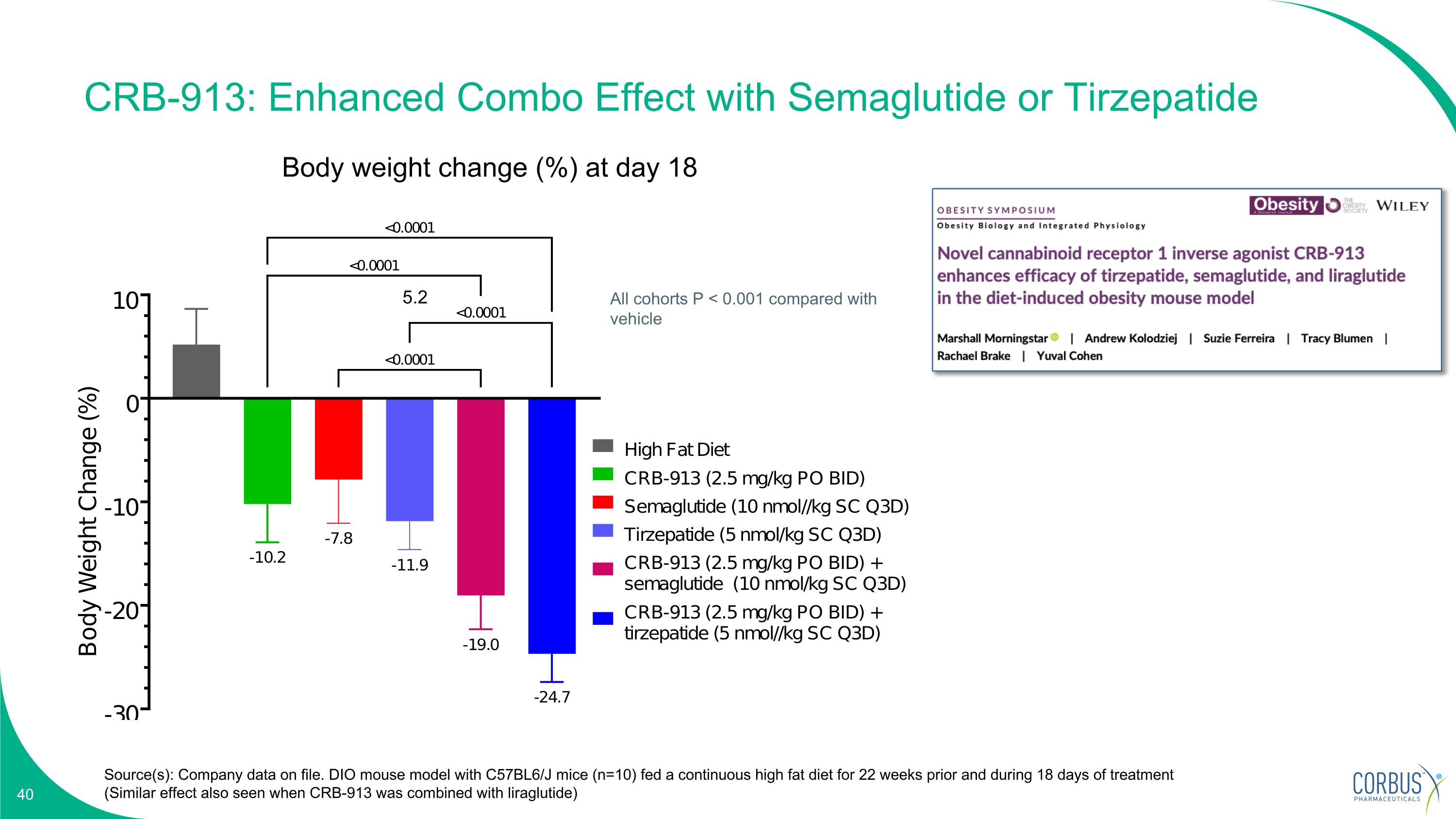

CRB-913: Enhanced Combo Effect with Semaglutide or Tirzepatide Source(s): Company data on file. DIO mouse model with C57BL6/J mice (n=10) fed a continuous high fat diet for 22 weeks prior and during 18 days of treatment (Similar effect also seen when CRB-913 was combined with liraglutide) Body weight change (%) at day 18 All cohorts P < 0.001 compared with vehicle 5.2

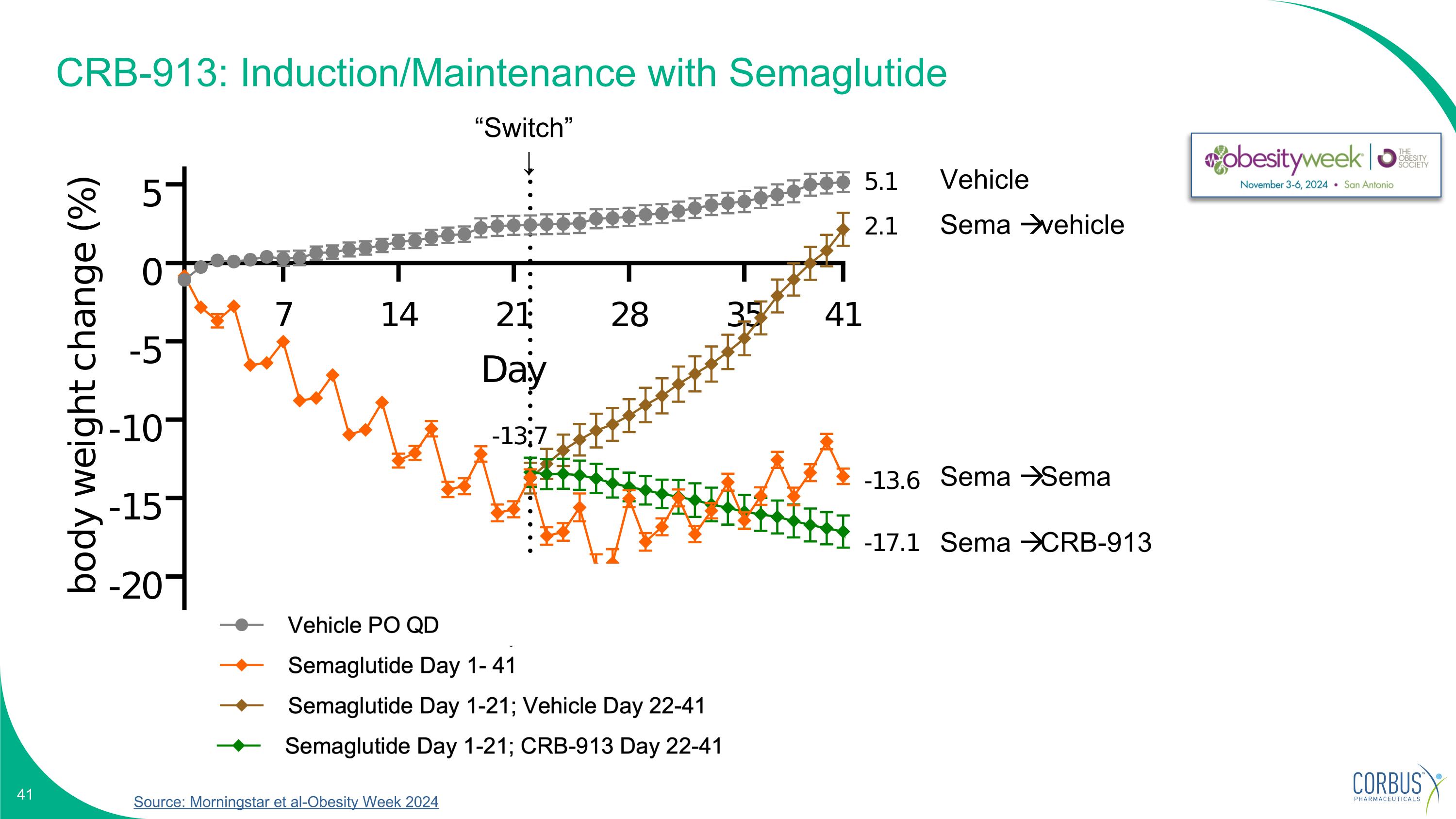

CRB-913: Induction/Maintenance with Semaglutide Source: Morningstar et al-Obesity Week 2024 “Switch” ↓ Vehicle Sema vehicle Sema Sema Sema CRB-913

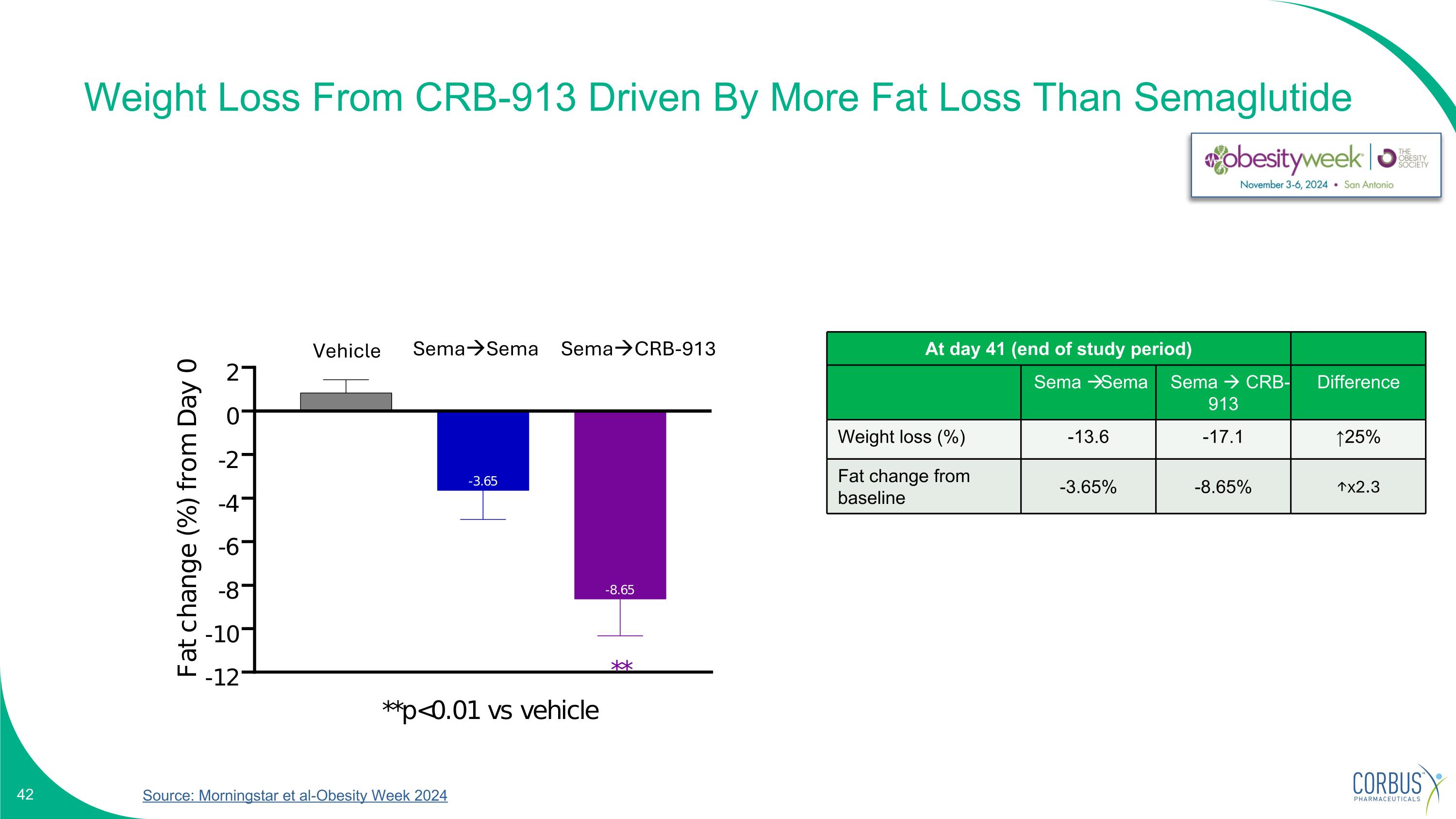

Weight Loss From CRB-913 Driven By More Fat Loss Than Semaglutide Source: Morningstar et al-Obesity Week 2024 SemaSema SemaCRB-913 At day 41 (end of study period) Sema Sema Sema CRB-913 Difference Weight loss (%) -13.6 -17.1 ↑25% Fat change from baseline -3.65% -8.65% ↑x2.3 Vehicle

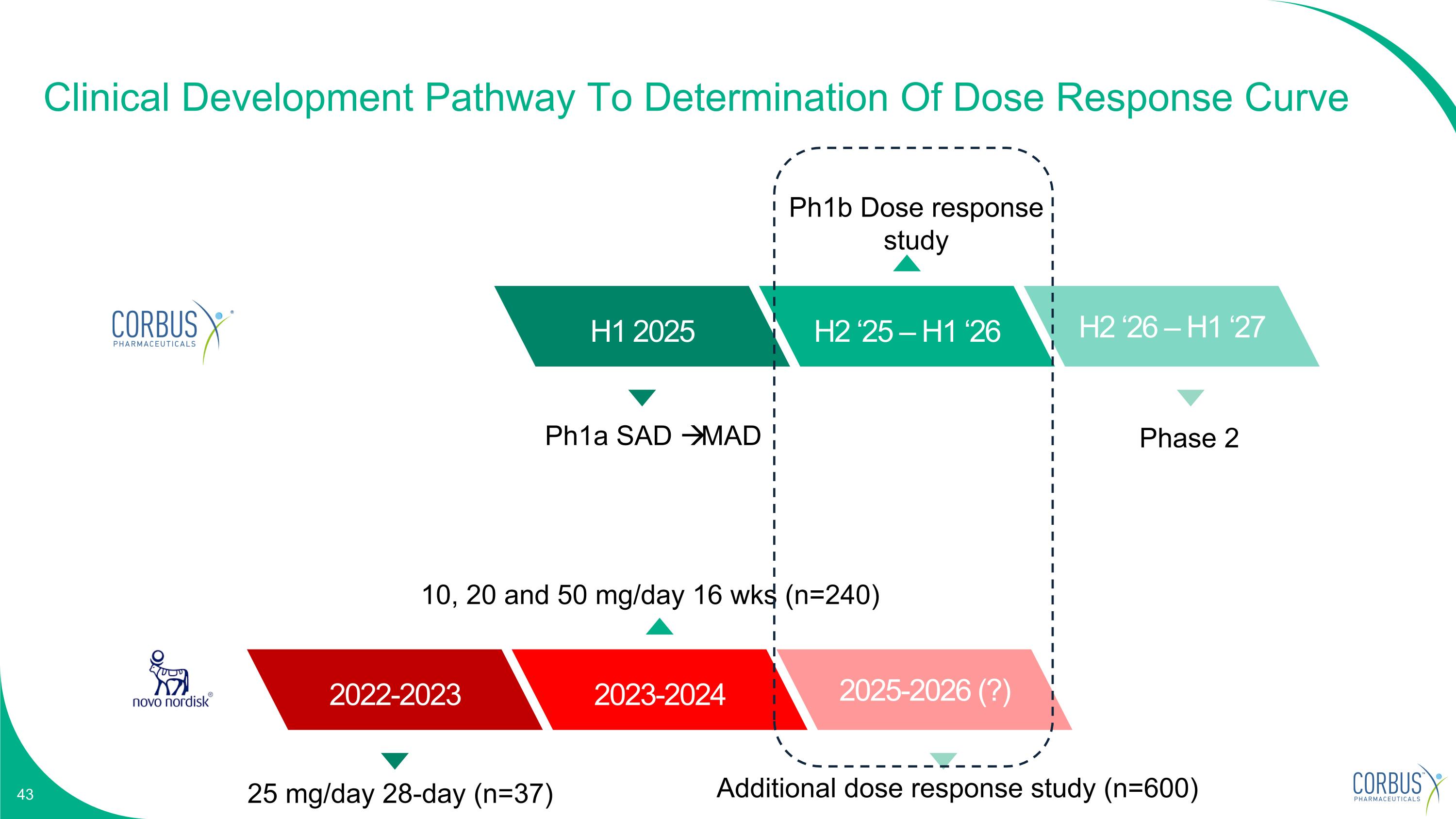

Clinical Development Pathway To Determination Of Dose Response Curve Q4 2024 H1 2025 H2 ‘25 – H1 ‘26 H2 ‘26 – H1 ‘27 Ph1a SAD MAD Ph1b Dose response study Phase 2 Q4 2024 2022-2023 2023-2024 2025-2026 (?) 25 mg/day 28-day (n=37) 10, 20 and 50 mg/day 16 wks (n=240) Additional dose response study (n=600)

Expected Milestones Produce drug for toxicology and clinical studies Q2-2024 Complete toxicology and IND enabling studies Q4-2024 FPI SAD/MAD Q1-2025

Leadership Upcoming Catalysts Financials

Management Team Sean Moran, CPA, MBA Chief Financial Officer Corbus co-founder and Chief Financial Officer since 2014. Prior senior financial management experience in emerging biotech and medical device companies. Christina Bertsch Head of Human Resources Accomplished senior human resource executive providing strategic HR consulting services to both large and small businesses across a variety of industries. Yuval Cohen, PhD Chief Executive Officer, Director Corbus co-founder and Chief Executive Officer since 2014. Previously the President and co-founder of Celsus Therapeutics from 2005. Dominic Smethurst, PhD Chief Medical Officer, MA MRCP Dr. Smethurst, MA MRCP, joined Corbus as our Chief Medical Officer in February 2024. He most recently served as CMO of Bicycle Therapeutics.

Board of Directors Amb. Alan Holmer Ret. Chairman of the Board More than two decades of public service in Washington, D.C. including Special Envoy to China; Former CEO of PhRMA. Winston Kung, MBA Director More than 20 years of senior financial, business development and investment banking experience; currently CFO of ArriVent. (NASDAQ:AVBP) Yuval Cohen, PhD Chief Executive Officer, Director Corbus co-founder and Chief Executive Officer since 2014. Previous the President and co-founder of Celsus Therapeutics from 2005. Anne Altmeyer, PhD, MBA, MPH Director 20 years of experience advancing oncology R&D programs and leading impactful corporate development transactions; currently President & CEO of TigaTx. Yong (Ben) Ben, MD, MBA Director 25 years of oncology R&D experience across industry and academia. CMO of BridgeBio Oncology Therapeutics and former CMO of BeiGene. Rachelle Jacques Director More than 25-year professional career, experience in U.S. and global biopharmaceutical commercial leadership, including multiple high-profile product launches in rare diseases; Former CEO of Akari Therapeutics. (NASDAQ: AKTX) John K. Jenkins, MD Director Distinguished 25-year career serving at the U.S. FDA, including 15 years of senior leadership in CDER and OND. Pete Salzmann, MD, MBA Director 20 years of industry experience and currently serves as Chief Executive Officer of Immunovant (NASDAQ: IMVT), a biopharmaceutical company focused on developing therapies for patients with autoimmune diseases.

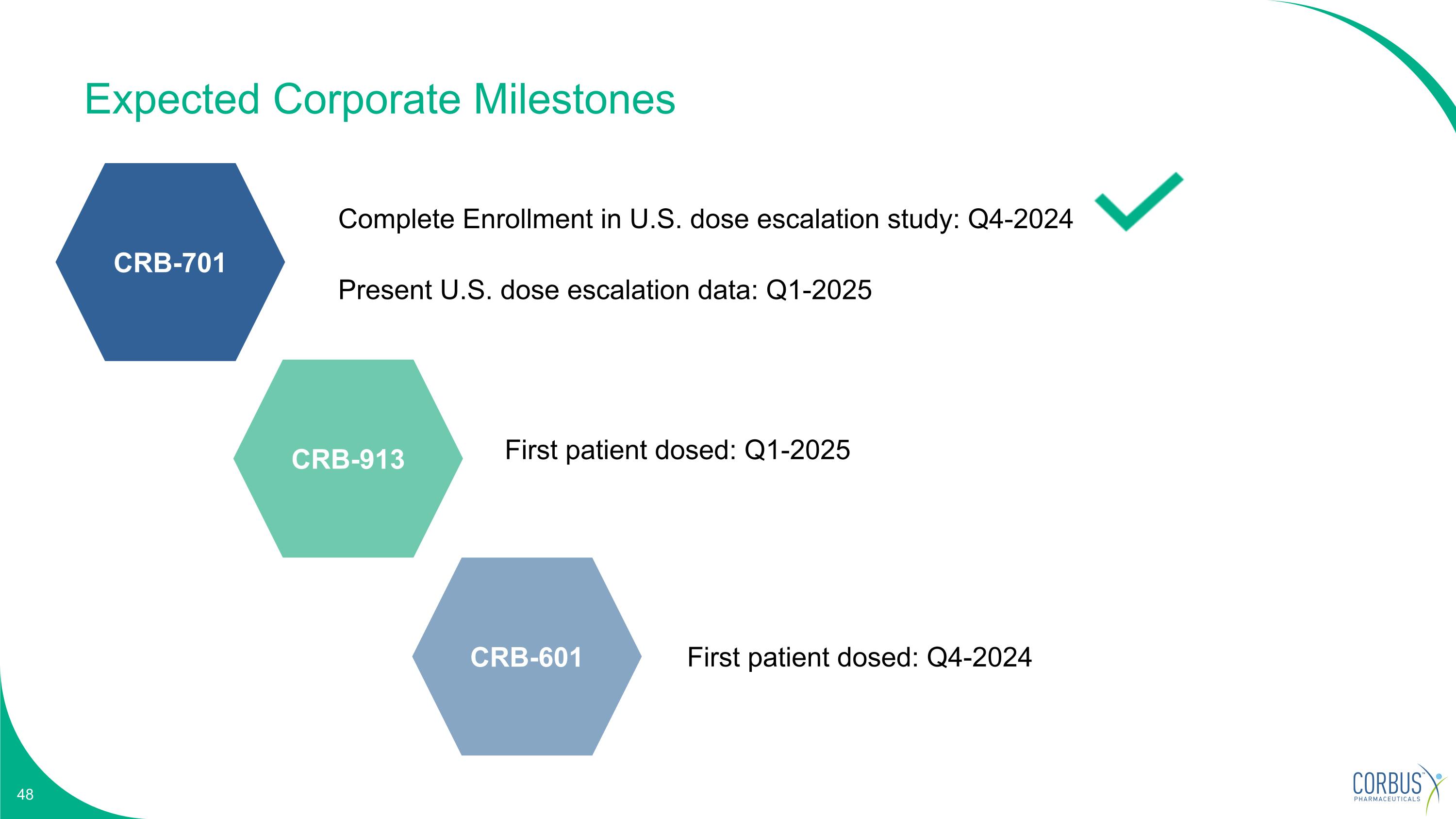

Expected Corporate Milestones First patient dosed: Q1-2025 First patient dosed: Q4-2024 Complete Enrollment in U.S. dose escalation study: Q4-2024 Present U.S. dose escalation data: Q1-2025 CRB-701 CRB-913 CRB-601

Investment Summary $159M Cash, cash equivalents and investments as of September 30, 2024. Approximately 12.2M Common Shares Outstanding (~13.2M Fully-Diluted Shares) Nectin-4 targeting ADC for treatment of solid tumors Oral CB1R inverse agonist to treat obesity TGFβ blocker Anti-⍺vβ8 integrin mAb for treatment of solid tumors CRB-913 CRB-601 CRB-701

Connecting Innovation to Purpose NASDAQ: CRBP Corporate Presentation November 7, 2024

Appendix

CRB-601 Potential “best-in-class” ⍺vβ8 mAb

CRB-601 has the Potential to Enhance Checkpoint Inhibition Focus on adopting a precision-targeted approach Novel mechanism to target TGFb in the tumor microenvironment Large opportunity potential if POC is validated

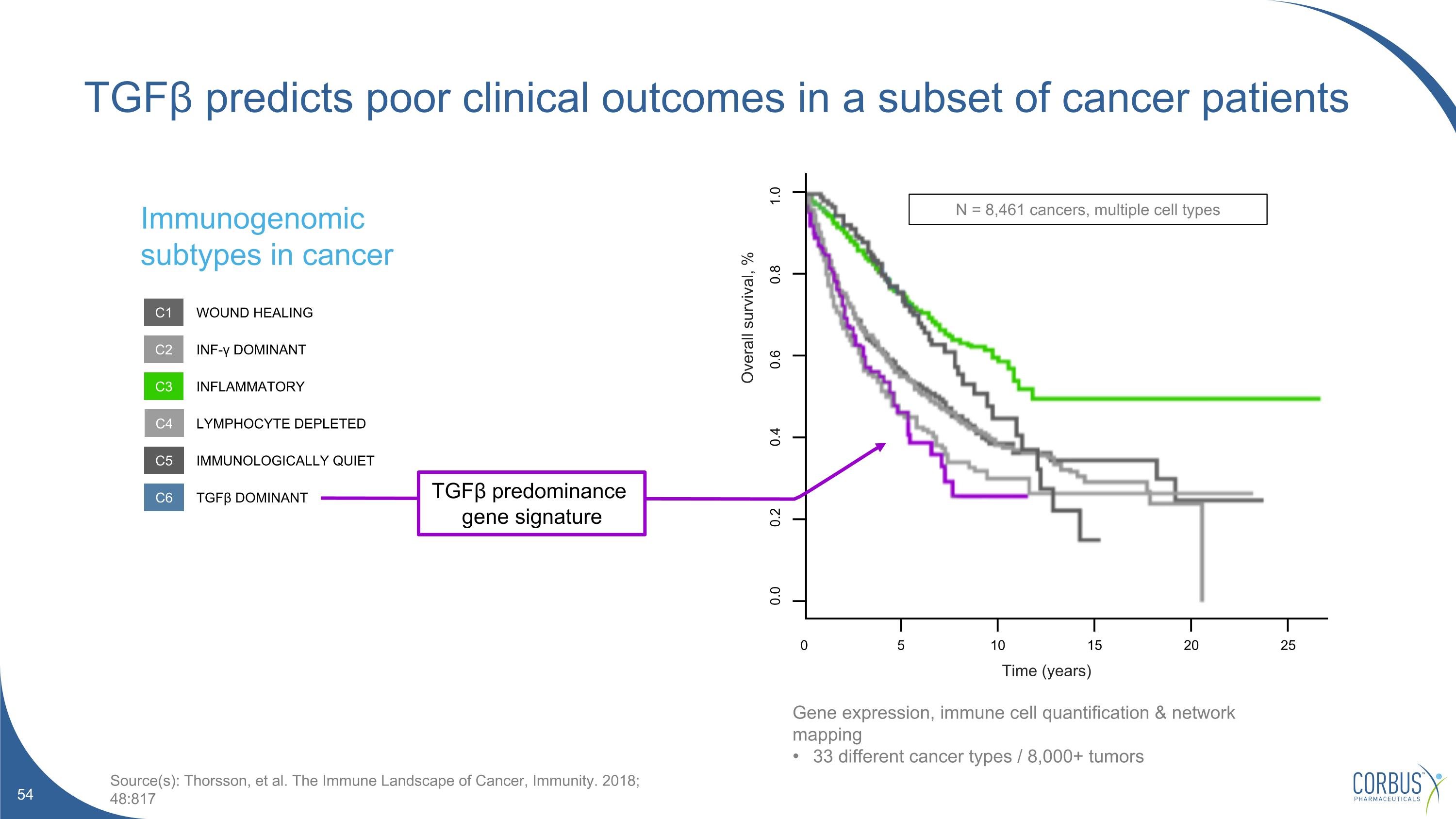

TGFβ predicts poor clinical outcomes in a subset of cancer patients 0 25 20 15 10 5 0.0 0.2 0.4 0.6 0.8 1.0 N = 8,461 cancers, multiple cell types Time (years) Overall survival, % Immunogenomic subtypes in cancer Source(s): Thorsson, et al. The Immune Landscape of Cancer, Immunity. 2018; 48:817 C1 C2 C3 C4 C5 C6 WOUND HEALING INF-γ DOMINANT INFLAMMATORY LYMPHOCYTE DEPLETED IMMUNOLOGICALLY QUIET TGFβ DOMINANT TGFβ predominance gene signature Gene expression, immune cell quantification & network mapping 33 different cancer types / 8,000+ tumors

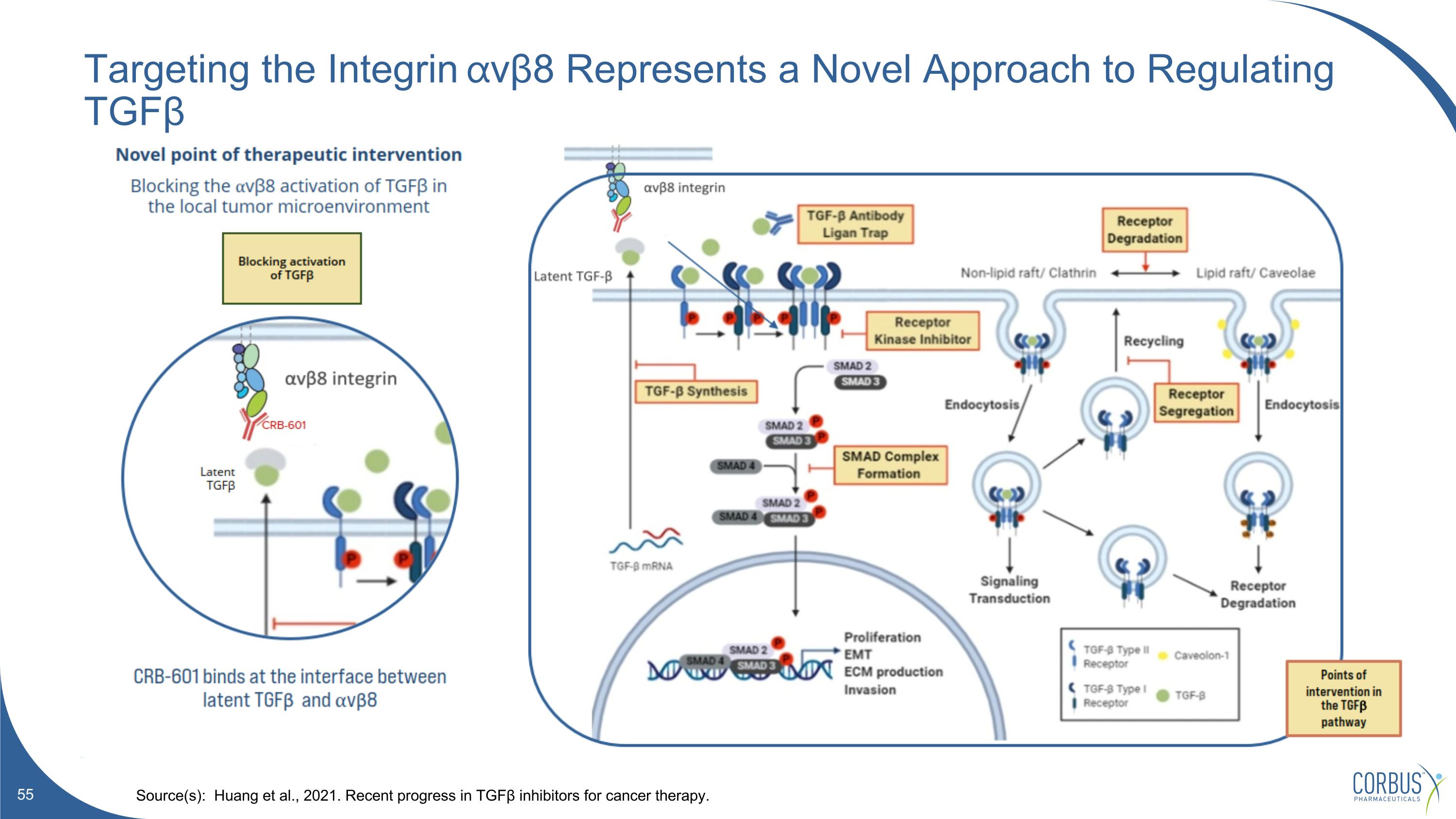

Targeting the Integrin ⍺vβ8 Represents a Novel Approach to Regulating TGFβ Source(s): Huang et al., 2021. Recent progress in TGFβ inhibitors for cancer therapy.

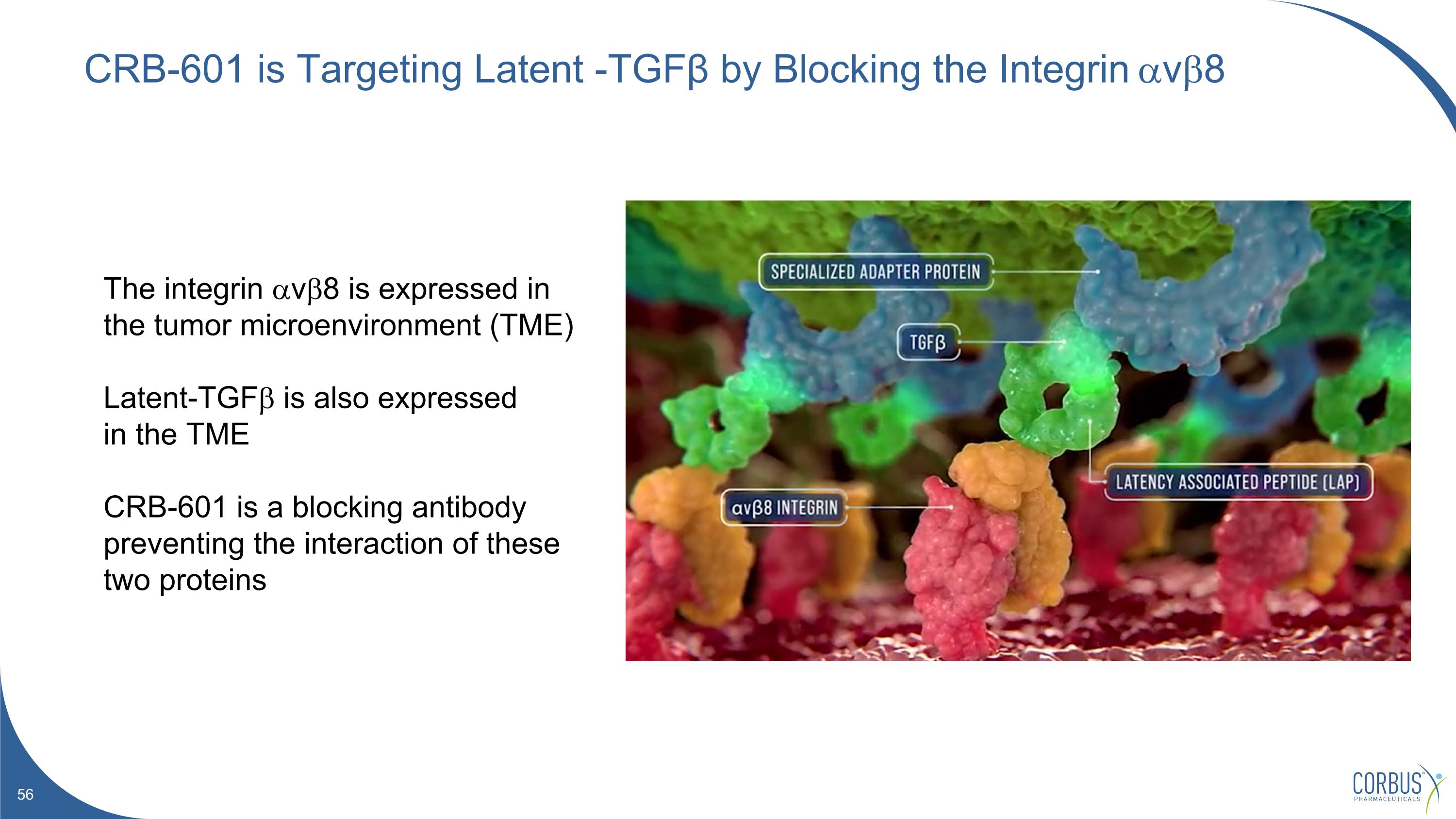

CRB-601 is Targeting Latent -TGFβ by Blocking the Integrin avb8 The integrin avb8 is expressed in the tumor microenvironment (TME) Latent-TGFb is also expressed in the TME CRB-601 is a blocking antibody preventing the interaction of these two proteins

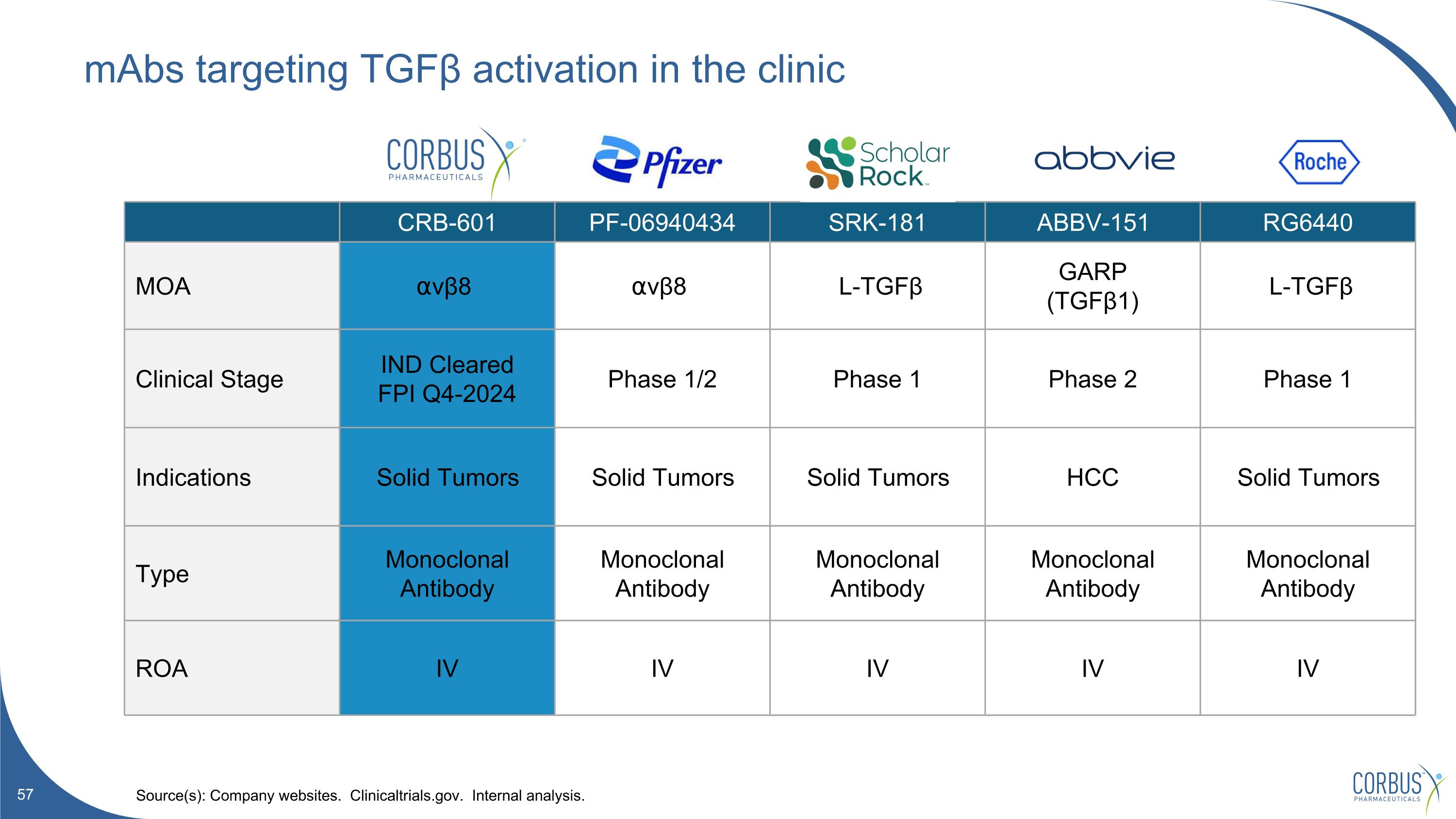

mAbs targeting TGFβ activation in the clinic Source(s): Company websites. Clinicaltrials.gov. Internal analysis. CRB-601 PF-06940434 SRK-181 ABBV-151 RG6440 MOA ⍺vβ8 ⍺vβ8 L-TGFβ GARP (TGFβ1) L-TGFβ Clinical Stage IND Cleared FPI Q4-2024 Phase 1/2 Phase 1 Phase 2 Phase 1 Indications Solid Tumors Solid Tumors Solid Tumors HCC Solid Tumors Type Monoclonal Antibody Monoclonal Antibody Monoclonal Antibody Monoclonal Antibody Monoclonal Antibody ROA IV IV IV IV IV

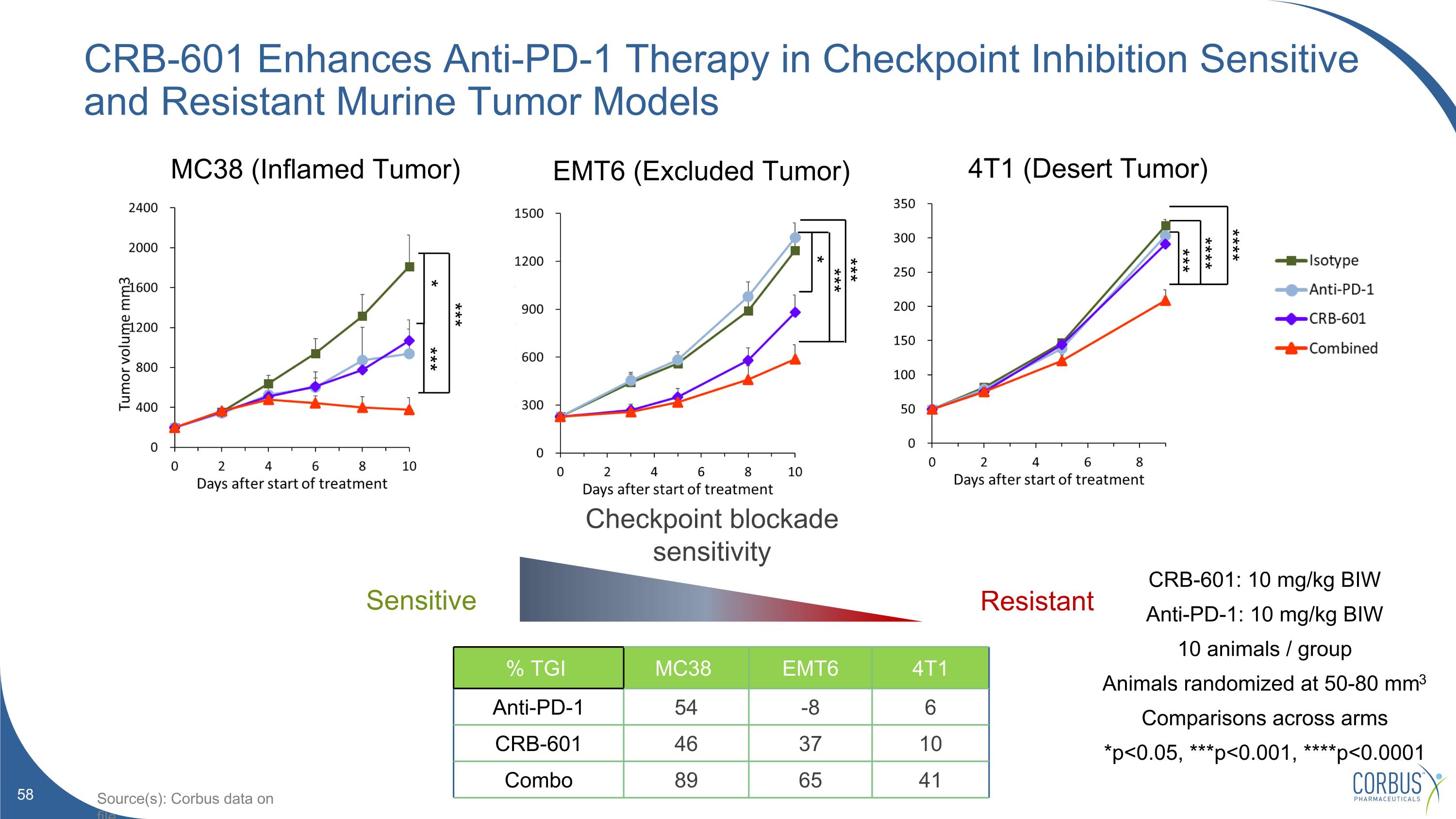

CRB-601 Enhances Anti-PD-1 Therapy in Checkpoint Inhibition Sensitive and Resistant Murine Tumor Models CRB-601: 10 mg/kg BIW Anti-PD-1: 10 mg/kg BIW 10 animals / group Animals randomized at 50-80 mm3 Comparisons across arms *p<0.05, ***p<0.001, ****p<0.0001 % TGI MC38 EMT6 4T1 Anti-PD-1 54 -8 6 CRB-601 46 37 10 Combo 89 65 41 Resistant Checkpoint blockade sensitivity Sensitive MC38 (Inflamed Tumor) EMT6 (Excluded Tumor) 4T1 (Desert Tumor) *** **** **** *** * *** *** *** * Source(s): Corbus data on file

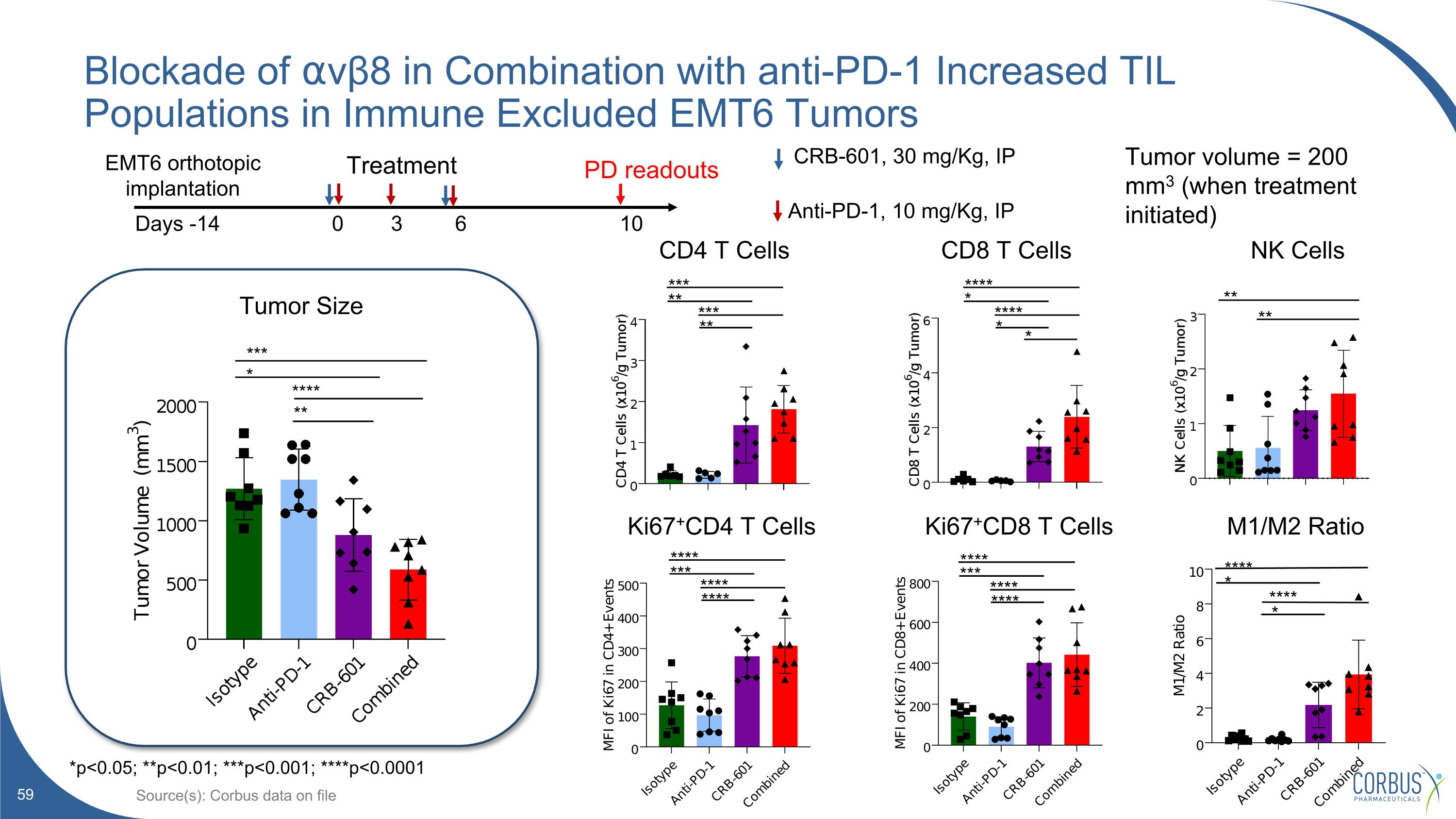

Blockade of ⍺vβ8 in Combination with anti-PD-1 Increased TIL Populations in Immune Excluded EMT6 Tumors Source(s): Corbus data on file **** *** **** **** **** *** **** **** Ki67+CD4 T Cells Ki67+CD8 T Cells CD4 T Cells CD8 T Cells Tumor Size * *** * **** ** *** ** *** ** **** * **** * Treatment Days -14 0 3 6 10 Anti-PD-1, 10 mg/Kg, IP CRB-601, 30 mg/Kg, IP EMT6 orthotopic implantation PD readouts Tumor volume = 200 mm3 (when treatment initiated) *p<0.05; **p<0.01; ***p<0.001; ****p<0.0001 M1/M2 Ratio NK Cells ** ** **** **** * *

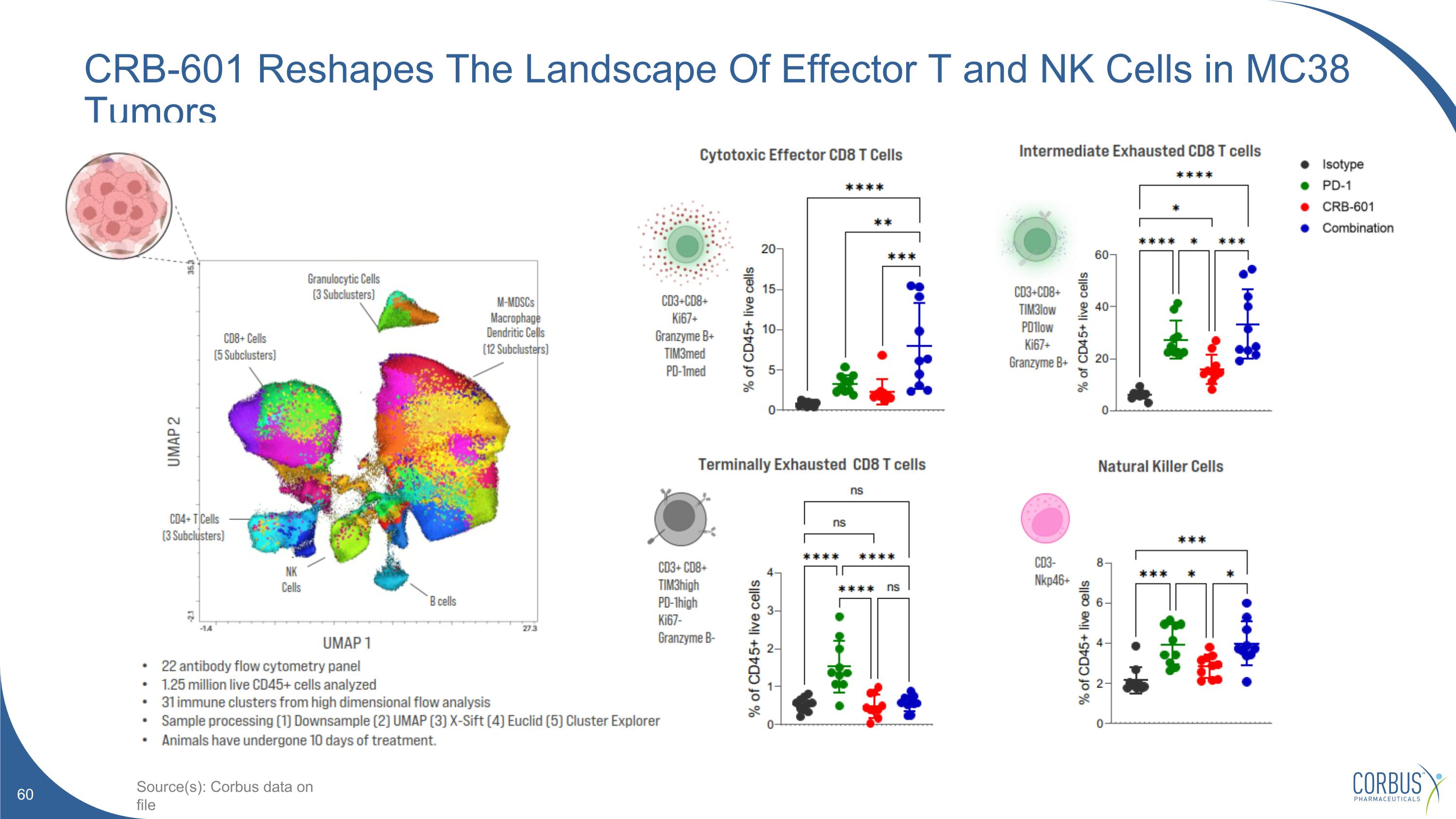

CRB-601 Reshapes The Landscape Of Effector T and NK Cells in MC38 Tumors Source(s): Corbus data on file

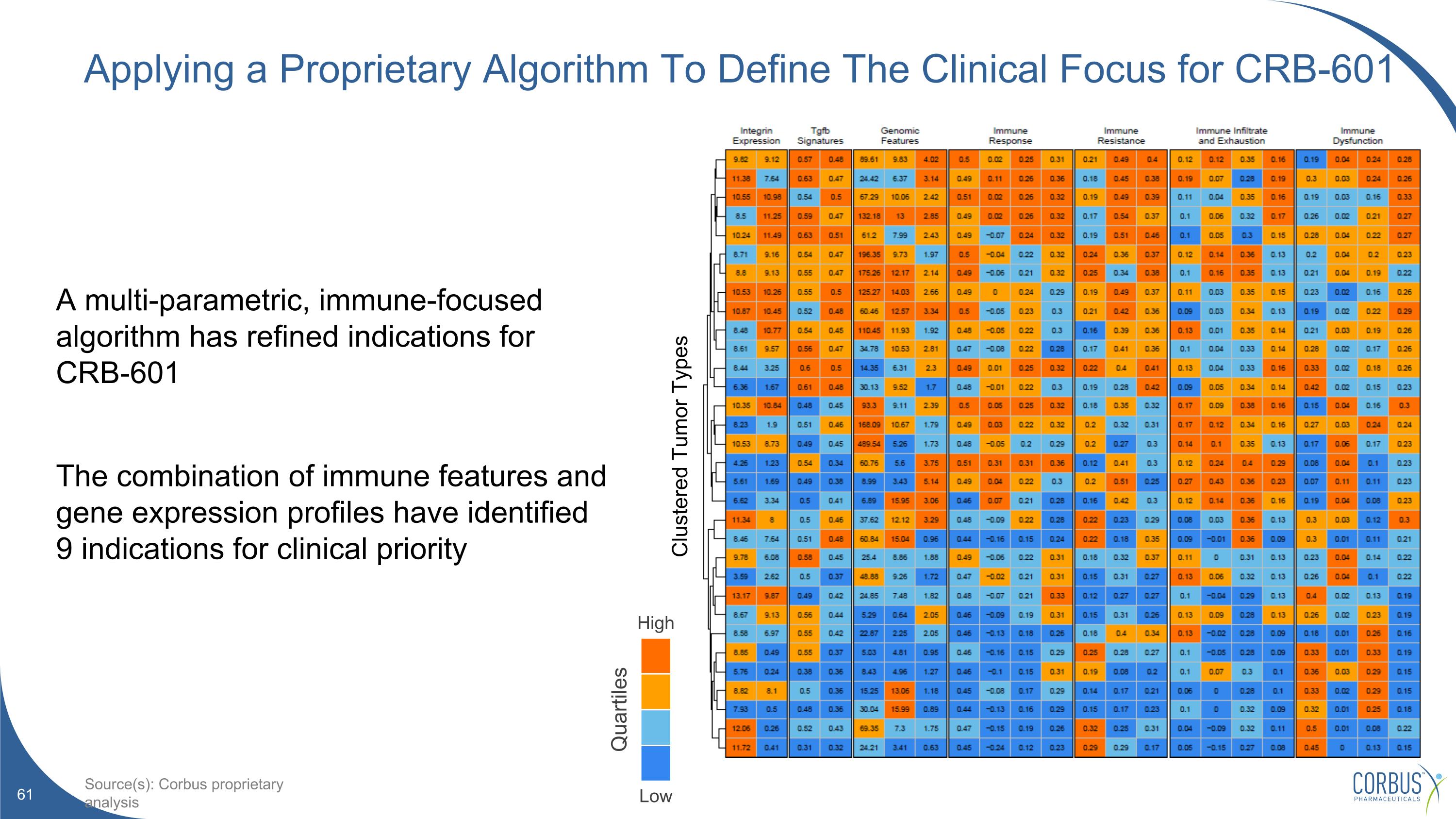

Applying a Proprietary Algorithm To Define The Clinical Focus for CRB-601 A multi-parametric, immune-focused algorithm has refined indications for CRB-601 The combination of immune features and gene expression profiles have identified 9 indications for clinical priority High Low Quartiles Source(s): Corbus proprietary analysis Clustered Tumor Types

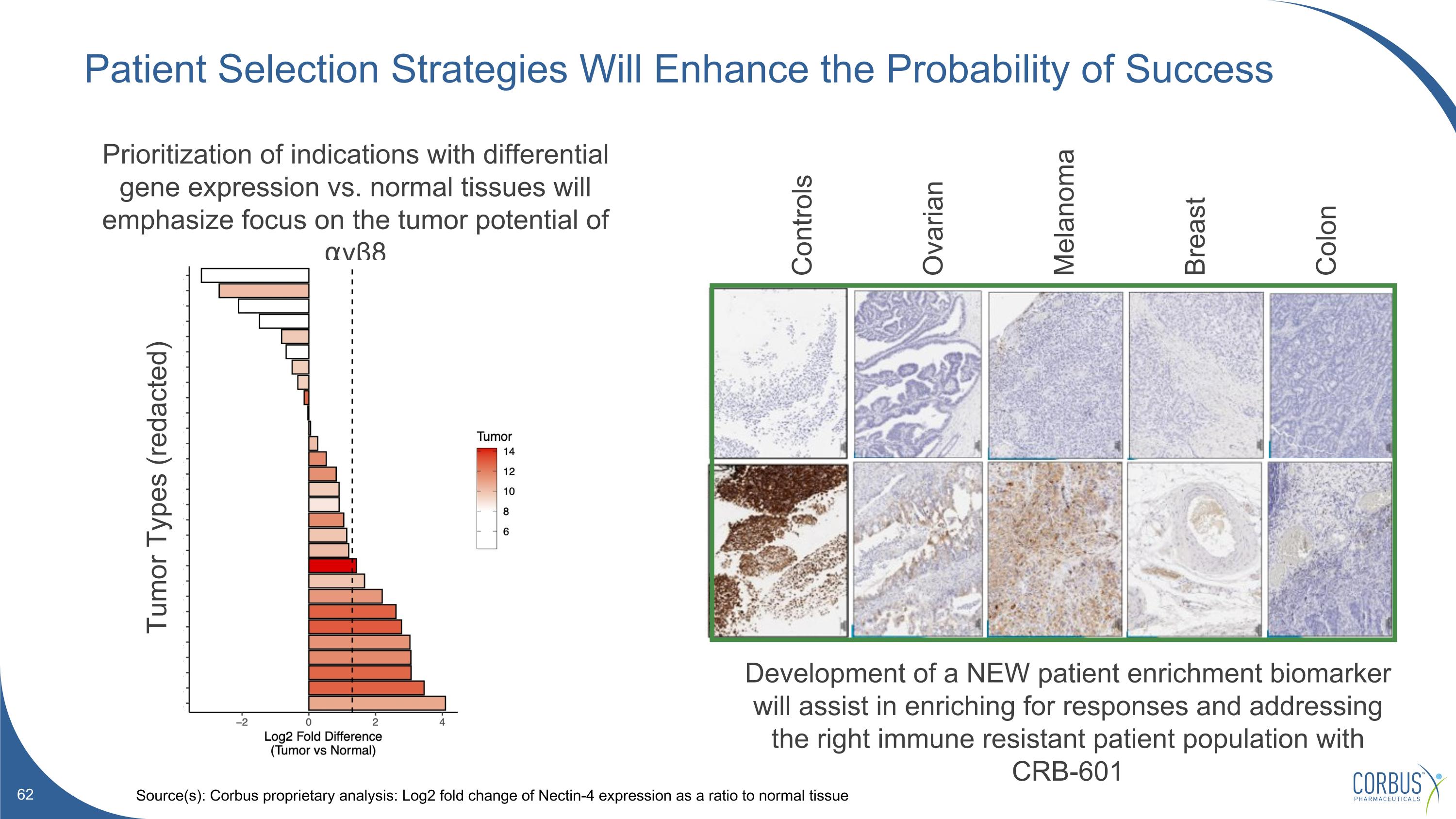

Patient Selection Strategies Will Enhance the Probability of Success Source(s): Corbus proprietary analysis: Log2 fold change of Nectin-4 expression as a ratio to normal tissue Controls Ovarian Melanoma Breast Colon Prioritization of indications with differential gene expression vs. normal tissues will emphasize focus on the tumor potential of ⍺vβ8 Development of a NEW patient enrichment biomarker will assist in enriching for responses and addressing the right immune resistant patient population with CRB-601 Tumor Types (redacted)

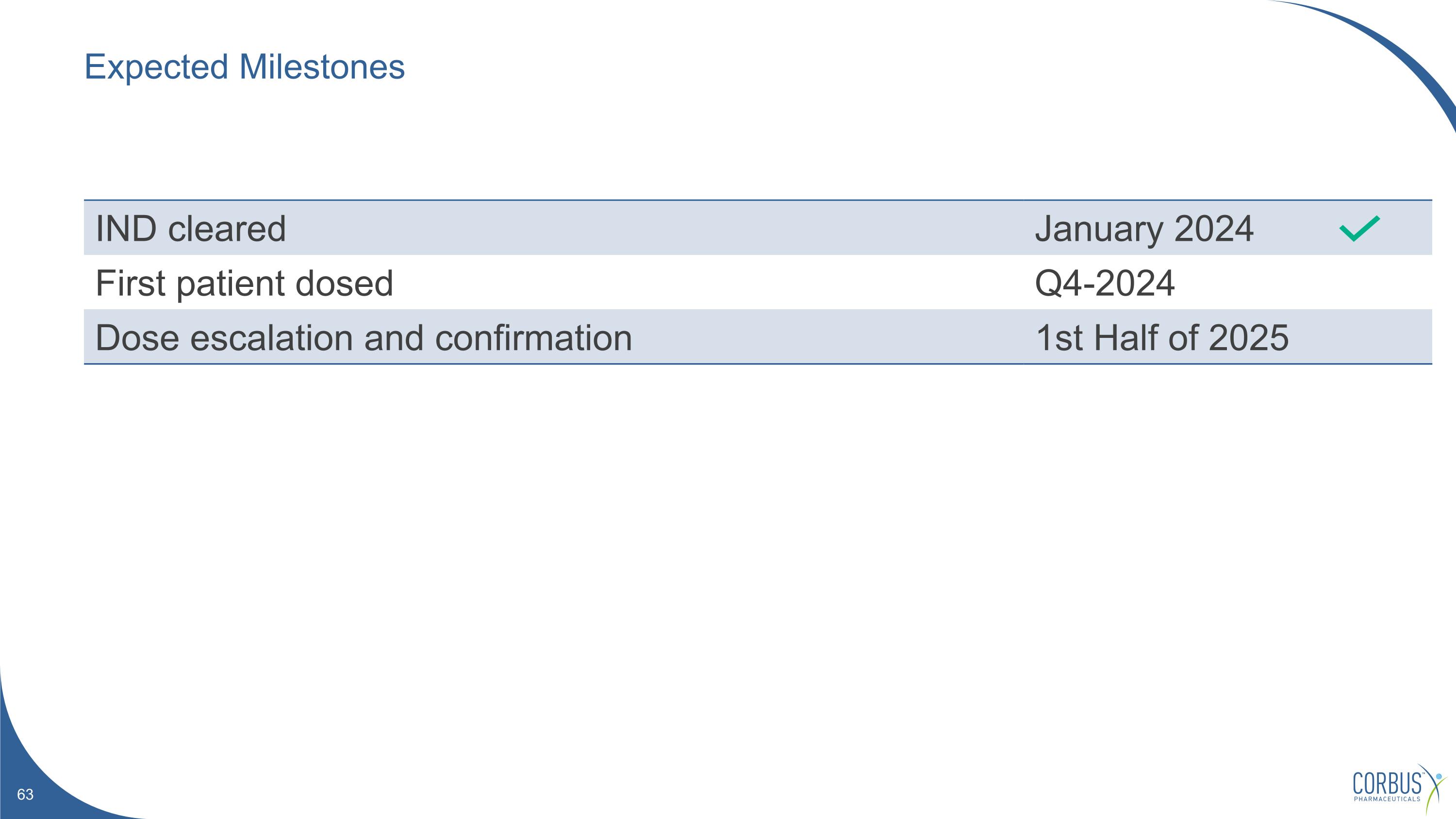

Expected Milestones IND cleared January 2024 First patient dosed Q4-2024 Dose escalation and confirmation 1st Half of 2025